Features and Benefits of Booke AI & How Small Businesses Are Growing with This AI Tool

Booke ai benefits for small business: Artificial intelligence (AI) is rapidly transforming every aspect of small business operations—including the age-old practice of bookkeeping. For many entrepreneurs, freelancers, and small business owners, keeping accurate financial records has always been a time-consuming, error-prone, and sometimes overwhelming responsibility. Enter Booke AI: an innovative, AI-powered bookkeeping solution that is revolutionizing the way financial records are managed, communications are handled, and business growth is achieved.

In this comprehensive blog, we’ll explore:

- What Booke AI is and how it reshapes bookkeeping,

- Its standout features and benefits,

- Real-world use cases and client testimonials,

- How small businesses are leveraging Booke AI for growth,

- The future of AI-driven financial management.

Table of Contents

- Introduction to Booke AI

- Core Features of Booke AI

- Robotic AI Bookkeeper

- Bookkeeping Automation

- Invoice & Receipt OCR AI

- One-Click Client Query Tool

- Real-Time Analytics & Interactive Reports

- Two-Way Integrations

- Month-End Close & Error Detection

- Secure Data Handling & Compliance

- Customizable Dashboards & Multi-User Access

- Key Benefits for Small Businesses

- Time Efficiency

- Enhanced Accuracy & Error Reduction

- Improved Collaboration & Client Satisfaction

- Cost-Effectiveness

- Scalability

- Better Decision-Making

- How Small Businesses Are Growing with Booke AI

- Accelerating Administrative Tasks

- Enabling Strategic Focus

- Reducing Overheads

- Scaling Operations with Confidence

- Real-Life Success Stories

- Booke AI vs. Traditional Bookkeeping

- Potential Limitations and Considerations

- Getting Started with Booke AI

- The Future: AI Bookkeeping as a Growth Engine

- Conclusion

Booke ai benefits for small business – How Small Businesses Grow with AI Bookkeeping

1. Introduction to Booke AI

Booke AI is an advanced platform that blends artificial intelligence, machine learning, and automation to streamline the once tedious, manual tasks of bookkeeping. Designed for accountants, bookkeepers, and especially small and medium-sized businesses, Booke AI aims to reduce human error, free up valuable time, and help business owners focus on what matters most—growth and profitability.

Booke ai benefits for small business – At its core, Booke AI eliminates repetitive data entry, error-checking, reconciliation, and endless client communications, providing a seamless and intelligent bookkeeping experience. By automatically reading invoices, receipts, and financial documents in any language or currency, and learning from transaction history, Booke AI delivers both accuracy and efficiency.

2. Core Features of Booke AI

Robotic AI Bookkeeper

- Acts as an intelligent, virtual accounting assistant.

- Fixes uncategorized transactions and provides guided reconciliation advice.

- Learns continuously from historical data and user corrections, improving over time (Booke ai benefits for small business).

Bookkeeping Automation

- Automates categorization, matching, and reconciliation of transactions.

- Dramatically speeds up financial workflows—up to 80% faster transaction categorization.

- Automatically flags discrepancies for review (Booke ai benefits for small business).

Invoice & Receipt OCR AI

- Uses Optical Character Recognition (OCR) to extract data from digital and scanned invoices, receipts, and bills in real time.

- Supports multi-language and multi-currency documents, ideal for international business.

- Reduces manual data entry and the risk of errors (Booke ai benefits for small business).

One-Click Client Query Tool

- Streamlines client communication by allowing accountants and business owners to quickly query clients about specific transactions in-app, bypassing lengthy emails and calls.

- Tracks status of sent queries, responses, and automated reminders (Booke ai benefits for small business).

Real-Time Analytics & Interactive Reports

- Generates customizable, real-time analytics for a bird’s-eye view of business health.

- Interactive reports can be shared or exported with one click—facilitating faster decision-making and transparency (Booke ai benefits for small business).

Two-Way Integrations

- Seamlessly integrates with popular accounting software like Xero, QuickBooks, and Zoho Books for data synchronization.

- Imports data from Dropbox, Google Drive, and email, enabling efficient document management (Booke ai benefits for small business).

Month-End Close & Error Detection

- Automates monthly reconciliations and identifies discrepancies, duplicate entries, and mismatched data.

- Provides AI-driven suggestions for resolving inconsistencies during close periods (Booke ai benefits for small business).

Secure Data Handling & Compliance

- Employs robust security protocols for data privacy and compliance with global standards.

- Offers secure file sharing and audit trails for all financial activities (Booke ai benefits for small business).

Customizable Dashboards & Multi-User Access

- Users can personalize dashboards to highlight important metrics.

- Supports multiple users, promoting collaboration among team members and accountants (Booke ai benefits for small business).

3. Key Benefits for Small Businesses

Time Efficiency

- Booke AI reduces bookkeeping hours by at least 2 hours per client each month, freeing up time for higher-value work.

- Automation allows financial professionals to handle more clients efficiently or allocate resources to business development (Booke ai benefits for small business).

Enhanced Accuracy & Error Reduction

- AI-driven categorization and automatic error detection minimize the chance of mistakes in entries and reports.

- Ongoing machine learning helps the platform continually self-improve, reacting to user adjustments and new transaction patterns (Booke ai benefits for small business).

Improved Collaboration & Client Satisfaction

- One-click query tool and integrated client portal foster direct, transparent communication and rapid response times.

- Fewer communication bottlenecks result in higher client satisfaction and faster resolution of issues (Booke ai benefits for small business).

Cost-Effectiveness

- Automation lowers the need for manual intervention, reducing operational and labor costs.

- The platform’s pricing structures, including free trials and scalable plans, cater to small businesses of all sizes and budgets (Booke ai benefits for small business).

Scalability

- As businesses grow, Booke AI can handle increasing transaction volumes and complexities without the need for proportional increases in staff.

- The platform adapts to changing business needs, supporting both solo practitioners and growing enterprises (Booke ai benefits for small business).

Better Decision-Making

- Real-time analytics and interactive reports bring financial clarity, allowing owners to make timely, informed strategic choices.

- Increased reliability in financial data boosts confidence with investors, partners, and creditors (Booke ai benefits for small business).

4. How Small Businesses Are Growing with Booke AI

Accelerating Administrative Tasks

Small businesses often have lean teams or solo founders who handle multiple roles—from sales and marketing to finances. Booke AI automates time-consuming administrative chores, freeing up owners to spend more time serving clients and growing their businesses (Booke ai benefits for small business).

Enabling Strategic Focus

With routine bookkeeping automated and financial data always up-to-date, small business owners can focus their attention on high-impact activities such as customer acquisition, product innovation, and market expansion (Booke ai benefits for small business).

Reducing Overheads

By minimizing the need for additional bookkeeping staff or expensive external accounting services, Booke AI directly supports stronger profit margins—allowing businesses to reinvest in growth initiatives without additional financial strain (Booke ai benefits for small business).

Scaling Operations with Confidence

Booke AI’s scalability means small businesses don’t have to overhaul their financial systems as they expand. Whether processing hundreds or thousands of transactions, or integrating with larger accounting platforms, Booke AI grows with the business (Booke ai benefits for small business).

Real-Life Success Stories

Many businesses report:

- Significant reduction in bookkeeper-client communication overhead,

- Fewer transaction errors and quicker month-end closes,

- The ability to process larger client portfolios without hiring more staff.

Testimonials highlight tangible business growth—faster invoicing, improved cash flow, and smoother audits—with Booke AI credited as a key driver.

5. Booke AI vs. Traditional Bookkeeping

| Aspect | Booke AI | Traditional Bookkeeping |

|---|---|---|

| Data Entry | Automated via OCR/AI | Manual, time-intensive |

| Error Detection | Instant, AI-driven | Relies on human oversight |

| Transaction Matching | Automatic, learns over time | Manual, often repetitive |

| Client Communication | In-app, real-time instruments | Email/phone delays, back-and-forth |

| Analytics/Reports | Instant, customizable dashboards | Generated manually, often delayed |

| Scalability | Scales easily with business needs | Requires more staff as business grows |

| Cost | Subscription; lowers labor costs | High labor or outsourcing costs |

| Integration | Syncs with cloud platforms | Manual data transfer or none |

| Learning/Adaptation | Constant machine learning | Dependent on human experience |

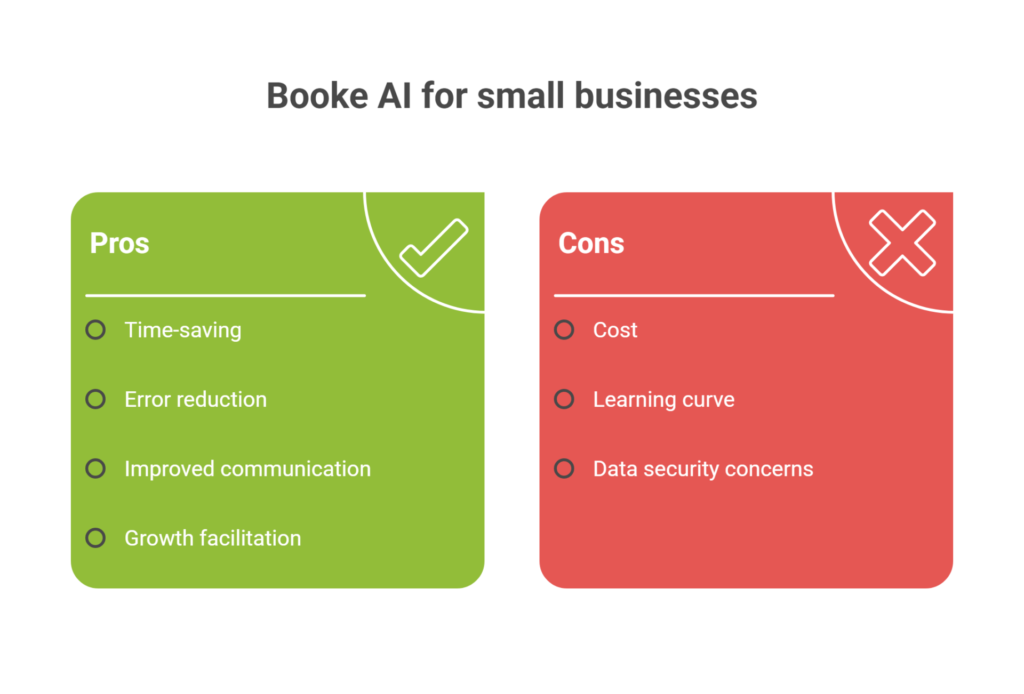

6. Potential Limitations and Considerations

No tool is perfect. Key considerations when deploying Booke AI:

- Learning Curve: New users may need some time to fully utilize advanced features, especially if unfamiliar with AI-driven solutions.

- Platform Integration: While Booke AI supports major accounting platforms, support for less common systems may be limited.

- Dependency on Digital Inputs: Booke AI performs best with digital documents; businesses reliant on physical paperwork may need to digitize their processes.

- Ongoing Subscription Costs: While overall more cost-effective, subscription fees may concern micro-businesses or sole practitioners.

- Manual Oversight: Though highly automated, best practice still recommends periodic human review, especially during early adoption or for complex transactions.

7. Getting Started with Booke AI

Setup is straightforward:

- Add your business and connect major platforms like Xero, QuickBooks, or Zoho Books.

- Set up document imports from cloud storage, email, or direct uploads.

- Leverage client portals to manage communication, query transactions, and track tasks.

- Customize analytic dashboards for instant insights into your business health.

Pricing Options:

- Data Entry Automation Hub: essentials for $20/month.

- Robotic AI Bookkeeper Plan: robust automation, reconciliation, and enhanced features at $50/month.

Free trials and scalable plans allow businesses to begin with minimal commitment and expand usage as needs grow.

8. The Future: AI Bookkeeping as a Growth Engine

The adoption of platforms like Booke AI signals a future where small businesses can compete with larger enterprises on financial agility and accuracy. As the software evolves, expect:

- Continuous feature updates in line with new accounting standards and technologies.

- Deeper integrations with more business tools—CRM, payroll, and banking.

- Greater automation of compliance, audit preparation, and forecasting.

- Stronger data-driven decision-making, giving small businesses a strategic edge.

The shift away from manual processes enables business evolution: owners spend less time on administration, and more on building customer relationships and expanding to new markets.

9. Conclusion

Booke AI is at the forefront of AI-powered financial management—redefining the bookkeeping experience for small businesses across industries. Its advanced features like OCR-driven data extraction, robotic bookkeeping, seamless integrations, and intelligent analytics not only eradicate repetitive workloads but create tangible paths to growth.

For small business owners, Booke AI isn’t just a tool, but a strategic partner—delivering efficiency, accuracy, collaboration, and the scalability needed to thrive in today’s fast-paced business environment. As digital transformation continues, embracing solutions like Booke AI is no longer optional for forward-thinking entrepreneurs; it’s essential for those who plan to lead and expand in their market.

Whether you’re looking to save time, cut costs, or make smarter, data-driven decisions, Booke AI proves that advanced bookkeeping can be simple, powerful, and a direct contributor to business growth.

Frequently Asked Questions (FAQ) About Booke AI Tool for Small Businesses

1. What is Booke AI?

Booke AI is an artificial intelligence-powered bookkeeping tool designed to automate and streamline financial recordkeeping, benefit accountants, bookkeepers, and especially small businesses by reducing manual workload and improving accuracy.

2. How does Booke AI help small businesses save time?

Booke AI automates repetitive tasks such as data entry, transaction categorization, and reconciliation, typically reducing bookkeeping hours for small businesses by at least 2 hours per client monthly.

3. Which accounting platforms does Booke AI integrate with?

It integrates seamlessly with popular accounting software including Xero, QuickBooks, and Zoho Books, alongside data imports from Dropbox, Google Drive, and email.

4. What core features does Booke AI offer?

Key features include a robotic AI bookkeeper, automated transaction categorization, invoice and receipt OCR, one-click client queries, real-time analytics, month-end close automation, secure data handling, and customizable dashboards.

5. How does Booke AI ensure data accuracy and error reduction?

Booke AI uses AI-driven categorization, ongoing machine learning, and automatic error detection, all working together to minimize mistakes and improve bookkeeping precision over time.

6. Is Booke AI suitable for micro-businesses or freelancers?

Yes. Booke AI offers scalable pricing and features that cater to solo practitioners, micro-businesses, and growing small businesses.

7. Can Booke AI handle multi-currency and multilingual documents?

Absolutely. Its OCR technology is equipped to process invoices and receipts across various languages and currencies, making it suitable for international operations.

8. How secure is my financial data on Booke AI?

Booke AI uses robust security protocols, data encryption, and audit trails to ensure privacy and meet global compliance standards.

9. Is human oversight required when using Booke AI?

Best practice recommends occasional human review, especially during early adoption or for complex transactions, even though the tool heavily automates most processes.

10. What are the benefits of the one-click client query feature?

It streamlines client communications, allows in-app queries regarding transactions, reduces email or call back-and-forth, and tracks the status of queries for timely resolutions.

11. How does Booke AI help in business decision-making?

The platform provides real-time, customizable analytics and reports, delivering clear insights to inform timely and strategic decisions.

12. What are the subscription costs for Booke AI?

Plans start around $20 per month for basic automation, with advanced robotic bookkeeper features available at $50 per month. Free trials and scalable options are also offered.

13. Does Booke AI support team collaboration?

Yes, Booke AI supports multi-user access and collaboration through customizable dashboards and secure data sharing.

14. What happens if my business grows—will Booke AI still fit?

Booke AI is designed to scale with your business, handling increased transaction volumes and offering features suitable for expanding operations.

15. How do I get started with Booke AI?

You simply create an account, connect your preferred accounting platforms, set up document imports, and personalize your dashboard. Free trials are available, making onboarding easy and risk-free.

One Comment