Finance Process Optimization: Why Automation Is Essential for 2025 Growth

The financial landscape is undergoing a seismic shift as organizations worldwide recognize that traditional manual processes can no longer keep pace with the demands of modern business. As we navigate through 2025, finance process automation has transitioned from being a competitive advantage to an absolute business necessity. With two-thirds of finance professionals expecting their accounts payable departments to be fully automated by 2025, and companies reporting up to 70% reduction in processing costs through intelligent automation, the message is clear: automation is not just transforming finance operations—it’s redefining the future of business growth itself.

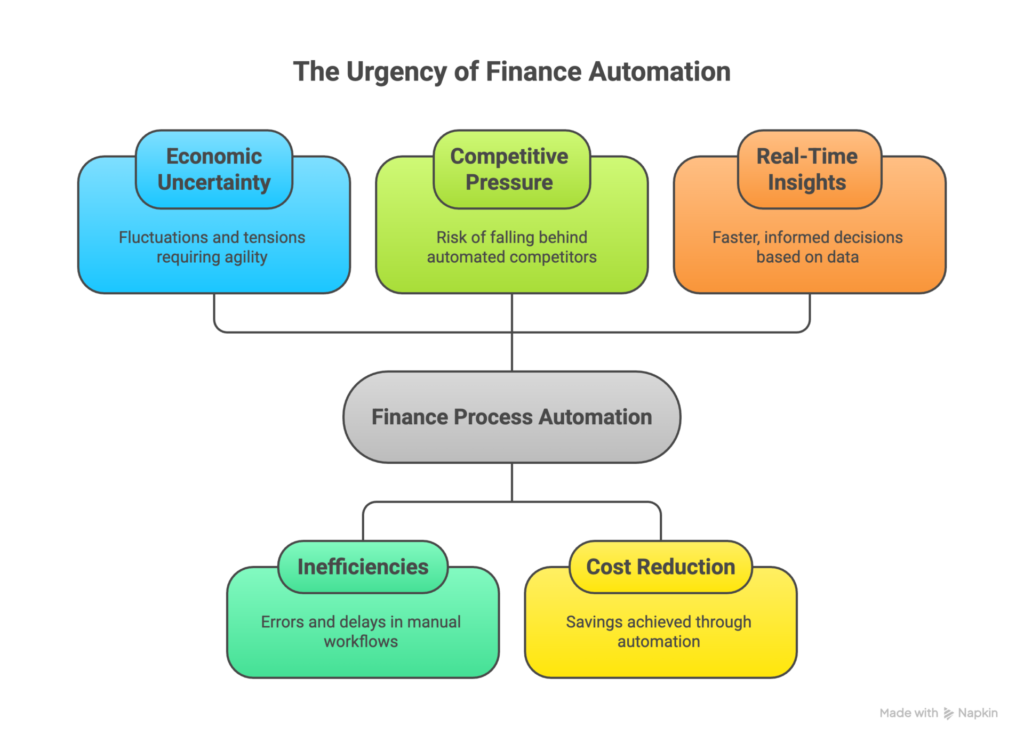

The urgency behind this transformation stems from multiple converging factors. Economic uncertainty, amplified by interest rate fluctuations and geopolitical tensions, demands unprecedented agility from finance teams. Organizations processing millions of transactions annually can no longer afford the inefficiencies, errors, and delays inherent in manual workflows. More importantly, businesses that fail to automate risk falling behind competitors who are leveraging technology to make faster, more informed decisions based on real-time financial insights.

The Current State of Finance Operations: A Breaking Point

Despite living in an increasingly digital world, a staggering reality persists: over 49% of invoices globally are still processed manually. This reliance on outdated methods creates a cascade of problems that directly impact an organization’s bottom line and competitive positioning. Manual financial processes are characterized by time-consuming data entry, prolonged approval cycles, high error rates, and limited visibility into real-time financial performance.

Traditional finance departments find themselves trapped in a reactive cycle, spending countless hours on repetitive transactional tasks like invoice processing, reconciliation, and report generation. This leaves minimal time for strategic activities that actually drive business value—financial analysis, forecasting, risk assessment, and strategic planning. The cost implications are substantial: manual invoice processing can take up to three minutes per invoice, while automated systems complete the same task in under 30 seconds.

The human toll is equally concerning. Finance professionals report decreased morale and increased turnover rates due to the repetitive nature of manual data entry work. Meanwhile, the risk of costly errors looms large. Even a small percentage of mistakes in financial transactions can translate into significant financial losses, compliance violations, and damaged supplier relationships. Organizations conducting month-end closes often require 7 to 25 days to complete the process manually, compared to just several hours with automation.

Understanding Finance Process Automation: Beyond Simple Digitization

Finance process automation represents far more than simply converting paper documents to digital formats. It encompasses the strategic use of advanced technologies—including artificial intelligence, machine learning, robotic process automation, and cloud computing—to automate time-consuming manual processes within finance departments. This transformation creates intelligent workflows that execute predefined steps with limited or no human intervention, dramatically improving speed, accuracy, and efficiency.

Modern automation solutions leverage multiple complementary technologies working in concert. Robotic Process Automation handles repetitive, rule-based tasks such as data entry, invoice matching, and bank reconciliation. Artificial intelligence and machine learning add a layer of intelligence, enabling systems to learn from historical data, identify patterns, detect anomalies, and make predictions about future outcomes. Cloud computing provides the scalable infrastructure necessary to process vast amounts of financial data in real-time, making automation tools accessible from anywhere.

Optical Character Recognition technology, enhanced by large language models, can now extract and validate data from invoices automatically—even from unstructured or semi-structured formats like PDFs or scanned documents. This capability eliminates one of the biggest bottlenecks in traditional accounts payable workflows. Meanwhile, advanced analytics and predictive modeling empower finance leaders to forecast cash flow, assess credit risk, and optimize resource allocation with unprecedented accuracy.

The Compelling Business Case: Quantifiable Returns on Automation Investment

The return on investment from finance automation is both substantial and measurable across multiple dimensions. Organizations implementing intelligent automation in their financial processes report an average 90% reduction in processing time, 70% decrease in processing costs, 95.5% operational accuracy, and an impressive 250% ROI within two years.

The time savings alone justify the investment. Companies using automation save up to 40% of their time on routine financial tasks, freeing finance professionals to focus on strategic initiatives that drive revenue growth. One major financial institution reduced check processing time by 76%—from seven minutes to just 90 seconds—saving 225 hours monthly. Another organization cut its invoice processing costs by up to 60% while simultaneously improving accuracy and compliance.

Beyond direct cost savings, automation delivers strategic advantages that compound over time. Enhanced accuracy minimizes the risk of errors in processes like invoicing, payment matching, and compliance reporting. Automated systems can handle increasing transaction volumes without requiring proportional increases in staffing, providing the scalability essential for business growth. Real-time data and analytics enable leaders to make informed financial decisions faster, responding agilely to market changes.

The impact on working capital management is particularly noteworthy. Automated accounts payable systems enable organizations to capture early payment discounts, avoid late payment penalties, and maintain stronger supplier relationships through consistent, timely payments. Finance teams report shortening their month-end close cycles by 50% or more, accelerating the availability of critical financial information for decision-making.

Key Areas for Automation Implementation in 2025

Accounts Payable Transformation

Accounts payable automation has emerged as one of the highest-impact areas for finance transformation. AI-driven optical character recognition and machine learning can extract data accurately from invoices, automatically cross-verify information against purchase orders and supplier records, and route approvals through proper channels without manual intervention. Organizations implementing AP automation report reducing invoice processing times by up to 70% while cutting costs by as much as 60%.

Modern AP automation solutions provide three-way matching capabilities that automatically validate invoices against purchase orders and receipts, significantly reducing the risk of duplicate payments or fraud. Payment runs sync directly to ERP systems, improving audit readiness and providing instant visibility into liabilities and cash forecasts. The result is a streamlined process that transforms accounts payable from a time-consuming administrative burden into a strategic function that optimizes cash flow and strengthens supplier partnerships.

Accounts Receivable Excellence

Automating accounts receivable processes accelerates cash collection, reduces days sales outstanding, and improves customer relationships. Automated billing systems generate and distribute invoices immediately upon transaction completion, while automated payment reminders ensure customers receive timely notifications about upcoming or overdue payments. Self-service portals enable customers to view invoice status, make payments, and resolve discrepancies independently, reducing the administrative burden on finance teams.

Predictive analytics powered by machine learning can forecast customer payment behavior with remarkable accuracy, identifying which accounts are likely to pay late and enabling proactive intervention. This capability allows organizations to segment customers based on payment likelihood and tailor collection strategies accordingly, optimizing resource allocation and minimizing bad debt exposure.

Financial Close Acceleration

The financial close process—traditionally one of the most stressful and time-intensive periods for finance teams—benefits enormously from automation. Automated reconciliation solutions can reduce manual work by up to 75%, saving more than 30 hours per month. Systems automatically collect financial data from various sources, consolidate information into unified databases, and perform complex reconciliation tasks that would take hours or days manually.

Real-time monitoring capabilities enable finance teams to identify and resolve issues during the closing period rather than after the fact, dramatically improving accuracy and reducing the need for subsequent corrections. Organizations report closing their books in days rather than weeks, providing senior leadership with timely financial information essential for strategic decision-making.

Cash Flow Management and Forecasting

Cash flow visibility ranks among the top priorities for financial executives, with 62% of top executives emphasizing its critical importance. Automation transforms cash management from a reactive, historical activity into a proactive, predictive capability. Automated cash management systems integrate data from ERP systems, bank feeds, and payment platforms, providing CFOs with a unified, real-time view of global cash positions.

Advanced forecasting models incorporating historical data, seasonality trends, and predictive analytics can achieve accuracy rates exceeding 90%. These systems automatically update forecasts based on real-time changes in customer payments, unexpected expenses, or market conditions, enabling finance leaders to anticipate cash flow gaps and take preventive action. The ability to generate multiple scenario analyses instantly—showing how changes in pricing, demand, or costs affect outcomes—proves invaluable for strategic planning in volatile markets.

Financial Planning and Analysis Enhancement

Financial planning and analysis automation empowers teams with real-time data access and advanced forecasting capabilities, translating to more informed decision-making and improved financial performance. Automated systems can process vast amounts of financial data to generate accurate budget forecasts, conduct variance analyses, and identify cost-saving opportunities without the errors inherent in manual spreadsheet-based processes.

Predictive analytics enables finance teams to move from reactive reporting to proactive strategic planning. Machine learning algorithms can improve corporate forecasting accuracy from approximately 80% to 90%, delivering measurable business value. This enhanced precision allows organizations to allocate resources more effectively, identify growth opportunities earlier, and mitigate risks before they materialize.

The Strategic Advantages: Beyond Cost Reduction

While cost savings provide the most immediately quantifiable benefit, finance automation delivers strategic advantages that fundamentally transform the role of finance within organizations. Automation elevates finance from a back-office transactional function to a strategic business partner driving growth and innovation.

Enhanced decision-making capabilities represent perhaps the most significant strategic benefit. By automating routine processes, CFOs gain the time and visibility necessary to focus on high-value analysis and strategic planning. Real-time, accurate data improves reporting quality, strengthens risk management, and supports faster, more informed decisions in dynamic markets. Finance leaders can shift from spending the majority of their time gathering and validating data to analyzing trends, modeling scenarios, and providing strategic recommendations to executive leadership.

Improved compliance and risk mitigation become inherent characteristics of automated financial systems. Automated processes follow standardized procedures and security protocols designed around organizational risk profiles and governance needs. Systems can be programmed to adhere to the latest regulations and standards, maintaining compliance automatically and reducing the risk of penalties. Detailed audit trails provide complete transparency into every financial transaction, simplifying audit preparation and regulatory reporting.

Scalability emerges as another critical strategic advantage. Automated systems can effortlessly handle increased transaction volumes without requiring proportional increases in headcount or infrastructure. This scalability proves essential for organizations experiencing rapid growth, pursuing mergers and acquisitions, or expanding into new markets. Finance capabilities can scale seamlessly alongside business growth, maintaining operational efficiency regardless of volume increases.

Emerging Technologies Shaping Finance Automation in 2025

Artificial Intelligence and Machine Learning Leadership

Artificial intelligence has evolved from a futuristic concept to the most significant disruptor in finance automation, moving beyond basic process automation to intelligent decision-making and predictive capabilities. A 2024 McKinsey survey found that 72% of financial institutions have integrated AI into their operations, with adoption rates more than doubling from 34% in 2024 to 72% in 2025.

AI enables finance teams to process high volumes of data quickly, providing actionable insights in real time. Generative AI capabilities now allow systems to automatically generate reports, visualizations, and recommendations, positioning finance as a critical driver of business performance rather than merely a reporting function. Machine learning models continuously improve their accuracy as they process more data, creating a “data network effect” where automation becomes increasingly effective over time.

Predictive Analytics Revolution

Predictive analytics represents a paradigm shift from reactive historical analysis to proactive future-oriented planning. By combining historical financial data, statistical models, and machine learning algorithms, predictive systems forecast future outcomes with remarkable accuracy. Finance professionals can forecast cash flows with precision, identifying potential shortfalls or surpluses well in advance and enabling proactive resource allocation.

Credit risk analysis benefits enormously from predictive modeling, with AI-driven engines predicting which sales may result in payment issues and allowing organizations to adjust terms proactively. Fraud detection capabilities have advanced dramatically, with machine learning identifying patterns that human analysts might miss and flagging suspicious activities in real time before they escalate into significant losses.

Cloud-Based Platform Dominance

Cloud-based finance automation platforms have become essential infrastructure for modern organizations. By 2028, half of all enterprises are expected to use industry cloud platforms to remain competitive. Cloud solutions provide universal accessibility, allowing finance teams to access critical information and execute workflows from anywhere, supporting remote and hybrid work models that have become standard.

The cloud enables seamless collaboration across teams and geographies, breaking down organizational silos that previously hindered efficiency. Automatic updates ensure organizations always operate with the latest features and security enhancements without disruptive implementation projects. Perhaps most importantly, cloud platforms offer the scalability to handle growing data volumes and transaction complexity without requiring significant capital investments in on-premise infrastructure.

Overcoming Implementation Challenges: A Roadmap for Success

Despite the compelling benefits, organizations must navigate several challenges when implementing finance automation. Resistance to change represents one of the most significant barriers, with employees often expressing concerns about job security or discomfort with new technologies. Successful implementations address these concerns proactively through transparent communication, comprehensive training programs, and clear articulation of how automation will enhance rather than replace human roles.

Data quality issues can undermine automation initiatives before they deliver value. Automation relies on accurate, consistent, and complete data; implementing automation on top of poor-quality data simply accelerates the propagation of errors. Organizations must invest in data cleansing initiatives, establish robust data governance policies, and ensure data accuracy at the source before deploying automation tools.

Integration complexity poses technical challenges that require careful planning and expert guidance. Finance automation solutions must integrate seamlessly with existing ERP systems, banking platforms, and other financial applications. Organizations should prioritize solutions offering pre-built integrations with commonly used systems and work with vendors experienced in implementing complex integrations to minimize IT burden and ensure reliable data flow.

Security and compliance concerns demand rigorous attention, particularly given the sensitive nature of financial data. Automated systems must incorporate robust security measures including multi-factor authentication, encryption, access controls, and regular security audits. Organizations should conduct thorough security assessments of automation vendors and implement continuous monitoring to detect and respond to potential threats promptly.

Best Practices for Successful Finance Automation Implementation

Organizations achieving the greatest success with finance automation follow a structured, strategic approach. The journey begins with a comprehensive assessment of current processes, identifying repetitive manual tasks consuming significant time and resources. Finance leaders should map out key workflows, pinpoint bottlenecks and pain points, and prioritize automation opportunities based on potential impact, implementation complexity, and strategic alignment.

Setting clear, measurable objectives provides essential direction for automation initiatives. Organizations should define specific targets such as reducing invoice processing time by a certain percentage, improving financial close cycle times, or achieving specific cost savings thresholds. These objectives create accountability and enable accurate measurement of return on investment.

Choosing the right technology partners and solutions requires careful evaluation. Organizations should prioritize vendors with proven track records in finance automation, robust security credentials, and strong customer support capabilities. Solutions should offer the flexibility to customize workflows to specific organizational needs, provide intuitive user interfaces that encourage adoption, and demonstrate the ability to scale alongside business growth.

Phased implementation approaches typically deliver better outcomes than attempting to automate everything simultaneously. Organizations can start with high-impact, lower-complexity processes like invoice processing or expense management, demonstrate value through these initial wins, and then progressively expand automation to additional areas. This approach minimizes disruption, allows teams to build expertise gradually, and creates momentum through early successes.

Continuous training and change management ensure sustainable adoption. Comprehensive training programs should equip finance teams with the skills needed to leverage automation tools effectively, while ongoing support addresses questions and challenges as they arise. Organizations should emphasize how automation enhances job satisfaction by eliminating tedious tasks and enabling focus on more strategic, fulfilling work.

The Competitive Imperative: Why Waiting Is Not an Option

The acceleration of finance automation adoption has created a widening gap between early adopters and laggards. Organizations implementing automation are processing transactions faster, making better decisions based on real-time data, and allocating resources more strategically than competitors still relying on manual processes. This advantage compounds over time as automated systems continuously improve through machine learning and as finance teams develop deeper expertise in leveraging technology for strategic advantage.

Market dynamics are increasingly unforgiving to organizations operating with outdated financial processes. Customer expectations for faster invoicing, flexible payment options, and transparent financial interactions continue rising. Suppliers prioritize partnerships with organizations offering efficient, reliable payment processes. Investors and stakeholders demand real-time financial visibility and sophisticated analytics that manual processes simply cannot deliver.

Regulatory complexity continues increasing across jurisdictions, with compliance requirements becoming more stringent and penalties for violations more severe. Manual compliance processes struggle to keep pace with evolving regulations, creating significant organizational risk. Automated compliance monitoring continuously scans transactions and documentation to ensure adherence to current standards, substantially reducing exposure to regulatory penalties.

The talent landscape further amplifies the urgency of automation adoption. Top finance professionals increasingly seek roles offering opportunities to work with cutting-edge technologies and focus on strategic activities rather than repetitive manual tasks. Organizations failing to modernize their finance operations risk losing talent to more technologically advanced competitors, creating a vicious cycle of capability decline.

Looking Ahead: The Future of Finance in an Automated World

The trajectory of finance automation points toward increasingly autonomous systems capable of handling complex decisions with minimal human intervention. AI-driven platforms will evolve from executing predefined workflows to making sophisticated judgments about payment timing, investment allocations, and risk mitigation strategies. Finance professionals will transition from performing tasks to overseeing intelligent systems, focusing their expertise on exception handling, strategic planning, and stakeholder communication.

Autonomous AI for finance represents the next frontier, with systems capable of evaluating vast volumes of market data, economic indicators, and geopolitical events to autonomously adjust portfolios, lending parameters, and operational processes. While today’s AI outputs still require human oversight, emerging technologies will increasingly enable systems to operate independently within defined parameters, dramatically accelerating response times and improving decision quality.

The integration of advanced technologies will create unprecedented analytical capabilities. Real-time data processing combined with sophisticated predictive modeling will enable finance leaders to conduct instantaneous scenario analyses, understanding the full implications of potential decisions before committing resources. Blockchain technology will enhance security, transparency, and efficiency in financial transactions, while federated learning will enable collaborative AI model development across organizations without compromising data privacy.

The role of finance professionals will continue evolving from transactional specialists to strategic business partners. As automation handles routine activities, finance teams will dedicate increasing time to activities that genuinely drive business value: identifying growth opportunities, optimizing capital allocation, managing strategic risks, and providing data-driven insights that shape organizational direction. This transformation elevates the profile and influence of finance within organizations, with CFOs increasingly recognized as essential strategic leaders rather than back-office administrators.

Conclusion: Seizing the Automation Opportunity

Finance process optimization through automation has reached an inflection point where the question is no longer whether to automate, but how quickly and comprehensively organizations can transform their financial operations. The evidence is overwhelming: automation delivers substantial cost savings, dramatic efficiency improvements, enhanced accuracy, better compliance, and strategic advantages that fundamentally strengthen competitive positioning.

Organizations taking decisive action now to implement comprehensive finance automation position themselves for sustainable growth in an increasingly complex, fast-paced business environment. Those hesitating risk falling irrevocably behind competitors who are leveraging technology to operate more efficiently, make better decisions, and respond more agilely to market changes. The financial and strategic returns from automation are too significant to ignore, and the penalties for inaction too severe to accept.

The path forward requires leadership commitment, strategic planning, appropriate technology investments, and organizational change management. However, the destination—a finance function operating with unprecedented efficiency, providing real-time strategic insights, and driving business growth—justifies the journey. As we progress through 2025 and beyond, finance automation will increasingly separate market leaders from followers, making it an essential investment for every organization committed to long-term success ancess and growth.

One Comment