Unlocking Financial Transformation: In-Depth Features of C3 AI Applications for Financial Services

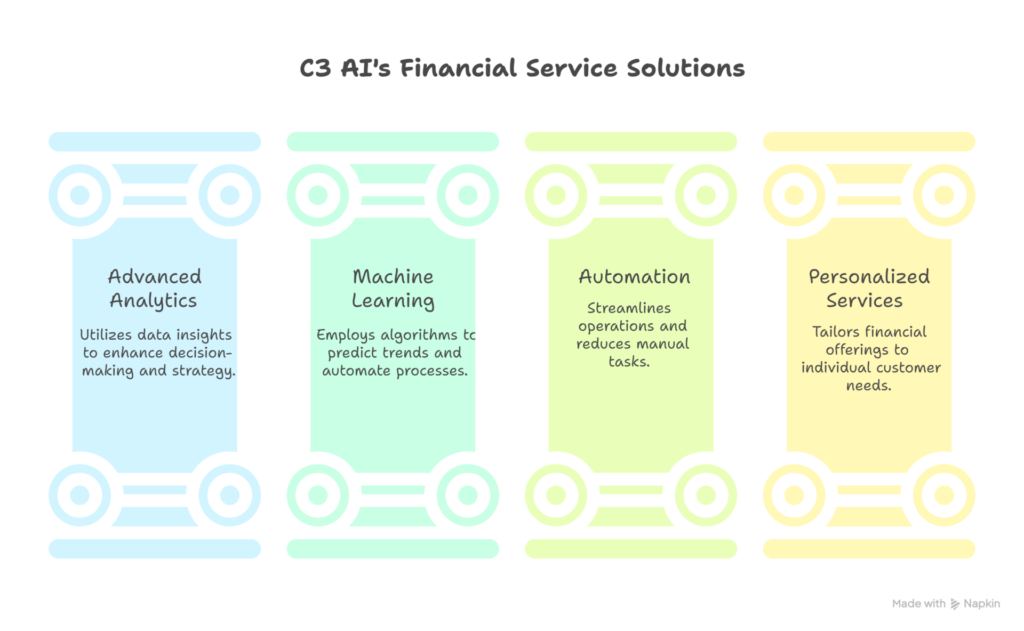

Today, the financial services sector faces a new set of challenges and opportunities demanded by rapid technological change. Institutions need to address complex risk, compliance, fraud, customer expectations, and operational efficiencies—all while enabling personalized services at scale. C3 AI brings a compelling suite of enterprise-grade AI applications specifically tailored for financial services, catalyzing digital transformation that addresses these obstacles with advanced analytics, machine learning, and automation.

This comprehensive guide explores the core features, architecture, and business impact of C3 AI Applications for Financial Services, putting a spotlight on how these tools unlock tangible advantages for banking, asset management, insurance, and other financial organizations.

C3 AI Applications for Financial Services – Key Features

Introduction to C3 AI in Financial Services

C3 AI delivers an advanced portfolio of AI-powered applications—purpose-built for financial institutions—that target high-value use cases like CRM, smart lending, cash management, anti-money laundering, risk analytics, and more. These solutions are engineered to integrate with legacy systems, unify enterprise data, and automate decision-making across banking, asset management, and insurance.

C3 AI’s strength lies in its ability to quickly and flexibly deploy applications that combine pre-built functionalities with the option to customize, promising a dramatic acceleration in time-to-value and cost-efficiency.

Key Features Overview

C3 AI Applications for Financial Services – C3 AI’s suite for financial services incorporates a wide set of features targeting the core needs of modern finance:

- Comprehensive, unified customer and account view

- AI-driven risk assessment and compliance automation

- Predictive analytics for credit, churn, profitability, and product demand

- Generative AI-powered search and insights

- Low-code/no-code customization and extensibility

- Model-driven architecture for rapid AI development

- End-to-end data integration across disparate systems

- Built-in auditability and governance for regulatory compliance

- Scalable deployment for teams and portfolios of any size

Let’s examine how each of these features transforms financial workflows and decision-making.

360° Customer View and Unified Data

C3 AI Applications for Financial Services – At the heart of C3 AI’s financial suite is the unification of all internal and external data sources to create a true 360-degree customer and portfolio view. This goes far beyond traditional CRM solutions by integrating:

- Transactions: Payments, balances, interest, account changes

- Products & Services: Treasury, investment banking, insurance, credit, and brokerage data

- Trading Activities: Orders, executions, settlements, and pricing

- Credit Histories: Applications, utilization, terms, collateral, contracts

- External Sources: News, market data, legal, and compliance feeds

This integrated data model not only provides a consolidated picture for customer relationship management but also acts as the foundation for advanced AI analytics—enabling more accurate profiling, personalized offers, and risk assessment.

AI-Powered Risk and Compliance

C3 AI Applications for Financial Services – Compliance and risk management are among the most complex, data-intensive challenges in finance. C3 AI Applications use advanced machine learning and automation to tackle:

- Anti-Money Laundering (AML): By unifying data across KYC, transaction monitoring, and watchlists, the platform helps identify suspicious activity with higher precision and fewer false positives.

- Regulatory Reporting: Automated workflows ensure timely, accurate, and auditable regulatory submissions.

- Fraud Detection: Patterns indicative of fraud are surfaced in real time, enhancing both detection rates and operational efficiency.

- Credit Risk Analytics: Early warning signals from structured and unstructured data help preempt loan defaults and market exposures.

AI-driven compliance not only lowers the burden on operations but also significantly reduces the risk of costly penalties due to non-compliance or fraud.

Smart Lending and Credit Origination

C3 AI Applications for Financial Services – Smart Lending represents a major step forward in speed and accuracy for commercial and retail credit origination. C3 AI’s lending features include:

- AI-Accelerated Underwriting: Risk is dynamically scored across thousands of factors, such as transaction history, market news, and past performance.

- Automated Application Processing: Low-risk candidates are pre-qualified automatically, slashing manual review times.

- Early Risk Identification: The platform uses predictive analytics to flag emerging borrower distress, enabling proactive actions.

- Integrated Credit Pipeline: All relevant data—from emails, documents, to contracts—are aggregated for each credit application, viewable from a single dashboard.

Institutions report not only faster decision times but also improved approval yields and risk-adjusted returns thanks to more accurate and transparent credit insights.

Revenue, Balance, and Product Forecasting

C3 AI Applications for Financial Services – C3 AI brings powerful predictive forecasting across multiple layers of financial services:

- Revenue Forecasting: Identifies market and client-specific trends, evaluates risk and opportunity, and guides teams on how to capture value.

- Balance and Attrition Prediction: Models capture daily volatility and link changes in balances to potential client dissatisfaction, allowing rapid intervention.

- Product Demand Forecasting: Anticipates trends for loans, deposits, and investment products and recommends treasury risk management actions.

These insights empower teams to make informed decisions on pricing, capital allocation, and customer offers, maximizing both profitability and resilience.

Client Profitability and Churn Management

C3 AI Applications for Financial Services – Client retention is a cornerstone of financial growth. C3 AI employs sophisticated models to:

- Assess Client Profitability: Clearly highlight which clients are beneficial and which are draining resources, recommending targeted strategies to drive up margins.

- Churn Risk Analytics: Natural language processing and behavioral analysis surface early warning signs—such as offering-need mismatches or sensitivity to fee changes—allowing preemptive action.

- Sentiment Analysis: Monitor communications and external signals to capture dissatisfaction and competitive threats in real time.

Financial institutions are thus equipped to protect their high-value relationships and address at-risk clients with speed and precision.

Rates and Fees Optimization

C3 AI Applications for Financial Services – Optimizing fee structures and pricing is critical in today’s competitive landscape. C3 AI enables:

- Dynamic Pricing Models: AI analyzes each client’s activities and sensitivities, suggesting optimal individualized rates and offers.

- Automation of Fee Adjustment Workflows: Streamlines approvals and communication with compliance audit trails.

- Impact Analysis: Pre-deployment simulations show projected impacts on revenue and retention, supporting data-driven pricing moves.

This lets financial organizations maximize value on a per-client basis without undermining customer satisfaction or regulatory constraints.

Cash Management and Attrition Prediction

C3 AI Applications for Financial Services – Managing business and retail deposits effectively is a make-or-break issue for banks. C3 AI’s applications target:

- Daily Balance Monitoring: Recognizes unusual withdrawal patterns and flags customer dissatisfaction or looming attrition.

- Segmented Churn Models: Distinguishes normal from concerning behaviors, enabling prioritized outreach by relationship managers.

- Early Intervention Strategies: Recommends targeted offers or service adjustments to retain at-risk deposits before they exit the institution.

The automated detection of attrition signals helps financial institutions protect their asset bases and proactively nurture client relationships.

Enterprise AI Platform Capabilities

C3 AI Applications for Financial Services – C3 AI’s general-purpose platform underpins all prebuilt applications, offering:

- Model-Driven Architecture: Dramatically accelerates AI solution development, requiring less code and faster testing cycles.

- Unified Data Layer: Seamlessly connects ERP, CRM, IoT, cloud, and proprietary systems for a consolidated record of all enterprise and extraprise data.

- Low-Code/No-Code Development: Puts power into the hands of business users, reducing dependence on scarce technical resources.

- Production-Ready AI/ML Tools: Native support for model versioning, monitoring, and deployment, ensuring high-impact models can be operationalized at scale.

This allows organizations to both deploy turnkey applications and rapidly develop custom solutions tailored to unique business challenges.

Generative AI for Deeper Insights

C3 AI Applications for Financial Services – A new frontier in financial services, C3 AI now embeds generative AI capabilities to:

- Empower Staff with Enterprise Search: Instantly retrieve answers and recommendations from millions of documents, market feeds, CRM notes, and more.

- Automate Report Generation: Dramatically reduce the effort and turnaround time for regulatory filings, customer reviews, and compliance reports.

- Contextual Analytics: Uncover hidden trends, compliance risks, and investment opportunities by synthesizing disparate data in natural language output.

- Role-Specific Insights: Credit officers, compliance experts, asset managers, and underwriters all benefit from targeted insights delivered on demand.

The integration of generative AI enhances both productivity and the depth of actionable analysis for key business users.

Custom Solutions and Scalability

C3 AI Applications for Financial Services – While C3 AI offers an impressive suite of pre-built financial solutions, the platform is equally designed for flexibility:

- Custom AI Application Development: Rapidly build bespoke solutions for new regulations, internal policies, or product innovations.

- Reusable Building Blocks: Model-driven workflows let teams assemble, test, and deploy new functionalities without starting from scratch.

- Enterprise-Grade Scalability: Serve teams of any size, portfolios across geographies, and multi-product institutions with reliability and speed.

This dual-mode—out-of-the-box solutions plus custom extensibility—ensures that institutions can keep pace with industry shifts while extracting value unique to their business.

Operational Efficiency and Accelerated Deployment

C3 AI Applications for Financial Services – Time-to-value is a defining factor in digital transformation. C3 AI’s applications are:

- Rapidly Deployable: Typical deployments move from project initiation to results in 3-6 months—a fraction of traditional AI initiatives.

- Proven at Scale: Used by large-cap global banks, insurers, and asset managers to handle billions in transactions and millions of client records.

- Automated Workflows: Reduces manual work, accelerates approvals, and frees up teams for higher-value strategic tasks across operations.

This allows organizations to rapidly capture returns and operational benefits, driving growth ahead of the competition.

Governance and Auditability

C3 AI Applications for Financial Services – Given the tight regulatory landscape in finance, C3 AI has embedded:

- Model Interpretability: AI recommendations are auditable and explainable, supporting trust with regulators and internal stakeholders.

- End-to-End Traceability: Every model’s predictions, data source, and workflow can be logged and reviewed for compliance purposes.

- Comprehensive Governance Frameworks: Automatic documentation, user access controls, and data management tools are built in.

Such features are essential for both internal policy adherence and meeting external regulatory mandates.

Business Impact and Results

C3 AI Applications for Financial Services – Financial institutions have reported significant, quantifiable benefits from deploying C3 AI Applications:

- Improved Risk Detection: Enhanced detection of fraud, AML activity, and credit risks with fewer false positives.

- Revenue Growth: Intelligent up-sell, cross-sell, and retention strategies boost client lifetime value.

- Operational Efficiency: Automation and streamlined analytics allow smaller teams to handle growing business and regulatory tasks.

- Faster Decisions: Lending cycle times cut by up to 30%, driving customer satisfaction and loyalty.

- Data-Driven Culture: AI insights embed a culture of informed, proactive decision-making across departments.

Return on investment can reach $100+ million annually for large organizations, with results manifesting in as little as 8-16 weeks after deployment begins.

Conclusion

C3 AI’s suite of applications for financial services delivers a best-in-class blend of unified data, predictive intelligence, regulatory robustness, and operational agility. From AI-powered CRM and risk analytics to AI-first compliance and generative AI-driven insights, the platform supports both the immediate needs and the future ambitions of global financial institutions.

Stepping beyond mere automation, C3 AI helps banks, wealth managers, and insurers transform into intelligent, resilient, and highly responsive organizations. In a world where data is the new currency, C3 AI’s tools provide the competitive edge required to thrive amidst complexity and change.

Frequently Asked Questions (FAQs) about C3 AI Applications for Financial Services

1. What are C3 AI Applications for Financial Services?

C3 AI Applications for Financial Services are AI-powered solutions designed to help financial institutions with risk management, compliance, fraud detection, customer analytics, lending, and more. They unify enterprise data and embed advanced analytics and automation to accelerate digital transformation.

2. How do C3 AI solutions integrate with existing financial systems?

C3 AI Applications provide seamless integration with legacy core banking systems, CRMs, ERPs, cloud services, and other data sources. Their unified data model allows organizations to leverage all internal and external data for comprehensive analytics and process automation.

3. What are the main features of C3 AI for financial organizations?

- Unified 360° customer and portfolio view

- Predictive risk and compliance analytics

- Smart lending and credit origination

- Revenue and product forecasting

- Churn management and client profitability analysis

- Dynamic rates and fee optimization

- Automated workflows for operational efficiency

4. How can C3 AI help in risk and compliance management?

C3 AI uses machine learning to identify complex risk patterns, automate regulatory reporting, improve fraud and AML detection, and reduce false positives. This strengthens compliance while lowering operational burdens.

5. Can these AI applications be customized?

Yes, C3 AI Applications are built on a model-driven, low-code/no-code platform. This enables organizations to tailor solutions for specific products, regulations, or workflows without lengthy development cycles.

6. How does generative AI enhance the platform?

Generative AI in C3 AI Applications enables powerful enterprise search, automated report generation, contextual analytics, and personalized role-specific insights, helping staff access actionable information faster.

7. Who can benefit from C3 AI’s financial solutions?

Banks, credit unions, asset managers, insurers, and other financial service providers can benefit, especially organizations seeking to modernize operations, enhance regulatory compliance, or drive better client outcomes through AI-driven insights.

8. How quickly can organizations deploy C3 AI Applications?

Deployments typically move from initiation to results in 3–6 months, much faster than many traditional digital transformation projects, allowing institutions to realize benefits rapidly.

9. How does C3 AI support data security and regulatory compliance?

The platform includes robust data governance, audit trails, model interpretability, and end-to-end traceability, helping organizations meet strict regulatory and internal policy requirements.

10. What business outcomes have financial institutions seen with C3 AI?

Reported benefits include improved risk detection, increased revenue, operational efficiency gains, faster loan approvals, enhanced client retention, and a stronger data-driven decision-making culture.

One Comment