How Understanding Indian Tax Regulations Can Skyrocket Your E-Commerce Growth

Indian Tax Regulations Ecommerce

How Understanding Indian Tax Regulations Can Skyrocket Your E-Commerce Growth

E-commerce is booming in India, and for businesses looking to tap into this growing market, understanding the tax landscape is crucial. With the right tax strategies, you can not only avoid costly mistakes but also leverage the system to maximize your profits. In this article, we’ll break down the critical tax regulations that can propel your e-commerce business forward, and how you can use them to your advantage.

Indian Tax Regulations Ecommerce

Understanding the Indian Tax System

India’s tax system is a complex but navigable framework that plays a pivotal role in the business environment, especially for e-commerce. Broadly, the country uses a multi-layered tax system, with taxes levied at the central, state, and local levels. For e-commerce businesses, understanding these regulations is critical for smooth operations and growth.

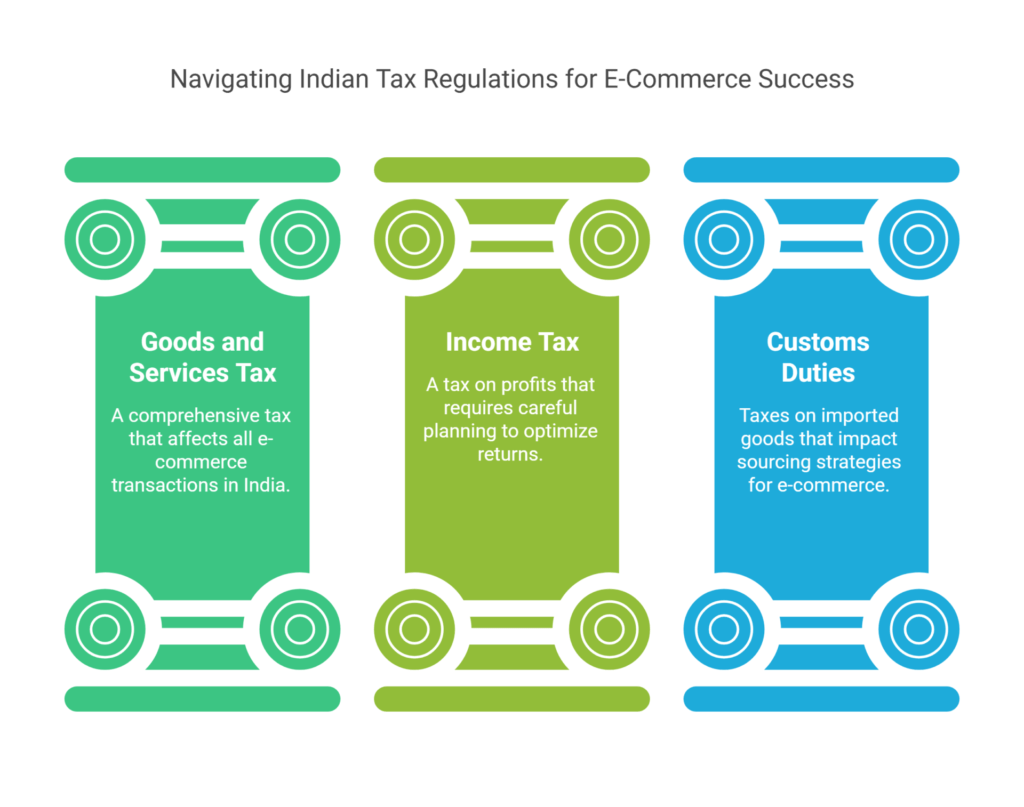

The primary taxes affecting e-commerce businesses in India include Goods and Services Tax (GST), Income Tax, and Customs Duties. Each one impacts different aspects of the e-commerce ecosystem, from sourcing products to selling them online.

The Goods and Services Tax (GST) Explained

GST and Its Importance for E-Commerce Sellers

GST, introduced in 2017, is one of the most important tax systems for e-commerce businesses in India. It is a value-added tax that is applied to both goods and services. Under the GST system, sellers collect tax from buyers at every stage of the production and distribution process.

For e-commerce businesses, understanding and complying with GST is crucial to avoid penalties. GST applies to goods and services sold online, and businesses must charge the appropriate rate on their products. The tax rate varies based on the type of product, but it typically falls between 5% to 28%.

Indian Tax Regulations Ecommerce

GST Registration and Compliance

If your business’s turnover exceeds a certain threshold (currently ₹40 lakhs for most states), you must register for GST. After registration, your business will be assigned a GSTIN (GST Identification Number), which is used to file returns and pay taxes. Failure to register or comply with GST can lead to heavy penalties and legal issues.

Benefits of GST for E-Commerce Businesses

While GST may seem daunting, it has several benefits for e-commerce businesses. For one, it streamlines the tax process by consolidating multiple taxes into one, which reduces the complexity of tax compliance. Furthermore, GST allows businesses to claim input tax credits, meaning you can deduct the tax paid on purchases related to your business.

Income Tax Implications for E-Commerce Entrepreneurs

Taxation of Income from Online Sales

As an e-commerce entrepreneur, your income from online sales is taxable under Income Tax in India. Your net income (after deducting expenses) is subject to tax according to the income tax slabs applicable to individuals or companies.

For example, if your business earns significant revenue, it may fall under the category of a Micro small or medium enterprise (MSME) and be subject to a tax rate of 30%. However, different tax rates apply depending on the legal structure of your business, whether it’s a sole proprietorship, partnership, or company.

Indian Tax Regulations Ecommerce

Deductible Expenses and Tax-Saving Strategies

E-commerce businesses can claim deductions on several expenses, including cost of goods sold (COGS), shipping, marketing, and salaries. Maximizing these deductions can help reduce your taxable income and save on taxes.

Additionally, businesses can explore tax-saving strategies such as investing in Research and Development (R&D) or other government-subsidized programs.

Tax Rates for E-Commerce Businesses

The tax rates for e-commerce businesses in India are determined based on the turnover, legal structure, and nature of the business. It’s essential to consult with a tax professional to determine which tax structure and rate applies to you.

Indian Tax Regulations Ecommerce

Import and Export Regulations

Tax Considerations for Importing Goods into India

If you’re sourcing products from outside India, you need to account for import duties and customs taxes. Import duties are taxes levied by the government when goods are brought into the country. Depending on the type of product, these duties can significantly affect your profit margins.

Export Tax Regulations and Benefits

India offers several incentives for businesses engaged in exporting goods, such as export duty exemptions and tax rebates. These benefits help reduce costs and increase the competitiveness of Indian businesses on the global stage.

Understanding these regulations ensures that you’re complying with customs duties while optimizing costs when exporting goods.

Indian Tax Regulations Ecommerce

Customs Duties and Exemptions

Importing goods from abroad also requires paying customs duties, which can be a challenge for e-commerce businesses. However, there are exemptions and rebates available under certain conditions, which can help lower your operational costs.

Challenges of Complying with Indian Tax Laws

Common Mistakes E-Commerce Businesses Make

Many e-commerce businesses overlook the complexity of Indian tax regulations. Mistakes such as failing to register for GST, incorrect filing of income tax returns, and not adhering to customs duty laws can lead to penalties and legal challenges.

Indian Tax Regulations Ecommerce

Navigating Complex Tax Forms and Filing Processes

The Indian tax system can be difficult to navigate, especially with its varying forms, deadlines, and payment methods. However, a clear understanding of the process and proper record-keeping can help simplify things.

How to Ensure Accurate Tax Reporting

Accurate tax reporting requires attention to detail. Businesses must maintain proper records of transactions, invoices, and expenses. Using accounting software or hiring a tax professional can help ensure compliance.

Indian Tax Regulations Ecommerce

How to Leverage Tax Benefits for E-Commerce Growth

Tax Incentives for Startups and MSMEs

India offers several tax benefits for startups and MSMEs, including tax exemptions and lower tax rates during the initial years of business. Leveraging these benefits can significantly reduce your tax burden and allow you to reinvest those savings into business growth.

Financial Planning to Minimize Tax Liabilities

Strategic financial planning can help you minimize your tax liabilities. By forecasting your tax obligations and expenses, you can structure your business operations in a way that reduces taxable income.

Indian Tax Regulations Ecommerce

Using Tax Benefits to Reinvest and Expand Your Business

Once you have reduced your tax liabilities, you can reinvest those funds into expanding your e-commerce operations. Whether it’s by investing in new products, marketing strategies, or scaling your operations, these tax savings can be a game-changer.

Technology and Tools for Tax Compliance

E-Commerce Tax Software Solutions

The digital age offers a range of tools and software solutions to help e-commerce businesses streamline tax compliance. From automated GST calculations to income tax filing tools, these technologies can save time and reduce the risk of human error.

Automation of Tax Processes for Efficiency

By automating tax processes, e-commerce businesses can ensure accuracy and efficiency. Automation allows businesses to stay compliant with changing tax regulations without overburdening their team.

The Role of Professional Accountants and Consultants

Hiring a tax professional or accountant can help your e-commerce business navigate complex tax regulations. These experts can ensure you’re not only compliant but also optimizing your tax position for maximum profitability.

Indian Tax Regulations Ecommerce

The Future of E-Commerce Taxation in India

Trends and Changes in Indian Tax Regulations

As e-commerce continues to grow in India, the tax landscape is likely to evolve. New regulations, digital tax reforms, and changes in global trade laws will impact how taxes are handled for online businesses. Keeping up with these trends is essential for staying ahead.

How Upcoming Changes Might Affect E-Commerce Businesses

The government may introduce new tax policies to address challenges in the e-commerce sector. Businesses need to prepare for potential changes by staying informed and adjusting their tax strategies accordingly.

Preparing for Future Tax Reforms

To ensure long-term growth, e-commerce businesses must stay adaptable to changes in tax laws. Regularly reviewing tax strategies and consulting with professionals can help businesses stay on top of these reforms.

Indian Tax Regulations Ecommerce

Conclusion

In conclusion, understanding Indian tax regulations is not just about avoiding penalties—it’s about using the tax system to your advantage. From GST compliance to tax incentives for startups, the Indian tax framework offers opportunities to optimize your business’s financial health. By strategically leveraging tax regulations, e-commerce businesses can reduce costs, expand operations, and ultimately skyrocket their growth.

What are the penalties for not complying with Indian tax regulations for e-commerce businesses?

Failure to comply with Indian tax regulations can result in hefty penalties, including fines and interest charges. In some cases, non-compliance may lead to legal action or suspension of business activities.

Indian Tax Regulations Ecommerce

Is GST applicable to all e-commerce businesses, regardless of their turnover?

No, GST registration is only mandatory for businesses whose annual turnover exceeds a certain threshold (₹40 lakhs for most states). However, voluntary registration is allowed for businesses with lower turnover.

How often do I need to file GST returns for my e-commerce business?

E-commerce businesses need to file GST returns monthly or quarterly, depending on the type of registration. GST returns are typically due by the 20th of the following month.

Are e-commerce businesses eligible for tax exemptions or rebates in India?

Yes, certain e-commerce businesses, particularly startups and MSMEs, are eligible for tax exemptions and rebates. These can include reduced GST rates and other financial incentives provided by the government.

Indian Tax Regulations Ecommerce

What types of goods are exempt from GST in India?

Certain goods, such as essential food items and health-related products, are exempt from GST. It’s important to check the latest GST guidelines to confirm which products qualify for exemption.

Can I deduct shipping costs and other logistics expenses from my taxable income?

Yes, shipping and logistics expenses directly related to the operation of your e-commerce business can be deducted from your taxable income as part of business expenses.

Thanks for reading this blog. Please share your feedback.

One Comment