How Values-Driven Organizations Build Competitive Advantage: Lessons from 15Five 2026

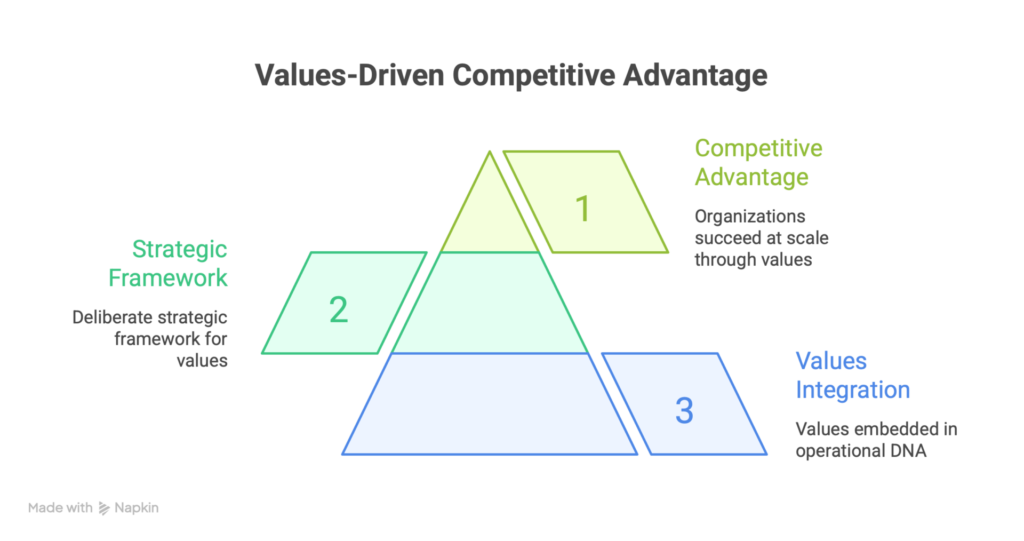

In the rapidly evolving landscape of modern business, where market dynamics shift faster than quarterly earnings cycles and talent retention becomes increasingly difficult, one principle remains constant: organizations that succeed at scale are those whose values transcend mission statements and become embedded in operational DNA.

15Five, a performance management platform that has emerged as a significant player in the enterprise software space, exemplifies this principle. The company’s stated commitment—to guide teams toward becoming their best selves, build trusted relationships, and align around extraordinary customer experiences—isn’t merely aspirational marketing. It represents a deliberate strategic framework that competitors would be wise to examine.

This examination matters. In 2026, as we navigate economic uncertainty, shifting workforce expectations, and intensifying competition for both talent and market share, understanding how values-driven organizations construct competitive advantages has moved from nice-to-have territory into essential strategic knowledge.

The Evolution of Values in Business Strategy

For decades, corporate values were treated as cultural window dressing. Companies drafted mission statements, printed them on lobby walls, and moved on. The assumption was clear: values were for internal morale, not external competitiveness. This assumption was wrong.

The shift began gradually but accelerated dramatically over the past five years. Institutional investors started demanding stakeholder governance frameworks. Customers increasingly voted with their wallets based on company values and social responsibility. Top talent—particularly skilled knowledge workers—began selecting employers based on cultural alignment rather than salary alone. The economics of values changed fundamentally.

What 15Five understood, and what distinguishes it from countless competitors, is that values create what economists call “structural advantages.” These aren’t advantages that diminish over time through competitive replication. Instead, they compound.

Consider the operational implications. When an organization genuinely commits to helping employees become their best selves, it doesn’t just improve morale—it creates measurable business outcomes. Employee engagement correlates directly with productivity. Productivity correlates with customer outcomes. Customer outcomes drive revenue growth and retention. This isn’t theoretical; it’s mechanistic.

The Three Pillars of Values-Based Competition

15Five’s framework rests on three interdependent pillars, each representing a distinct competitive advantage mechanism.

Pillar One: Internal Excellence Through Genuine Development

The first pillar—becoming your best selves—addresses a fundamental organizational challenge: most companies claim to develop talent while simultaneously extracting maximum value from existing capacity. This creates internal friction. Employees recognize the disconnect. Engagement drops. Turnover increases.

15Five’s approach inverts this logic. The platform enables continuous feedback, transparent goal-setting, and regular check-ins that create psychological safety. When employees know that their development matters as much as quarterly output, behavior changes. People invest in skill-building. They take calculated risks. They contribute ideas beyond their immediate job description.

The competitive advantage here is profound but indirect. Companies that genuinely invest in employee development create organizational flexibility. During market disruptions, these companies can redeploy talent internally rather than cycling through external recruitment. During growth phases, they can accelerate scaling because institutional knowledge lives within the organization. During contractions, they retain the institutional memory necessary for recovery.

15Five’s competitors—traditional HR platforms and legacy performance management systems—typically focus on compliance and documentation. They ask: “How do we measure and record performance?” 15Five asks a different question: “How do we accelerate human potential?”

This philosophical difference creates measurable business outcomes. Organizations using 15Five report higher engagement scores, lower voluntary turnover, and faster onboarding of high performers. These aren’t nice-to-have metrics. In knowledge-intensive industries, turnover costs—measured in lost productivity, institutional knowledge, and recruitment expenses—can represent 50-200% of an employee’s annual salary. Reducing voluntary turnover by even 10% generates substantial financial impact.

Pillar Two: Relationship Capital as Durable Advantage

The second pillar—building trusted relationships—operates at multiple levels: internal team dynamics, manager-employee relationships, and crucially, customer relationships.

Traditional enterprise software companies treat customer relationships as transactional. They sell a contract, provide support, and hope for renewal. This approach leaves enormous value on the table. It treats the customer relationship as a commodity rather than an asset.

15Five’s approach treats every interaction as an opportunity to build relationship capital. This manifests in product design (user-friendly interfaces that reduce frustration), customer success operations (proactive engagement rather than reactive support), and company culture (employees who genuinely care about customer outcomes, not just ticket resolution).

Why does this matter competitively? Because relationship capital creates switching costs that have nothing to do with contractual lock-in. A customer considering 15Five’s alternative might face a functionally superior competitor. But if the 15Five relationship is characterized by trust, transparency, and genuine partnership, the decision calculus changes. The cost of switching isn’t just the new software; it’s the cost of rebuilding trust with a new vendor.

This dynamic explains why companies with strong relationship capital maintain premium pricing. They’re not overcharging; they’re capturing the value they’ve created through relationship building. 15Five’s customer retention rates reflect this dynamic. In an industry where churn is endemic, 15Five has built a cohort of customers that renew year after year, not because they can’t leave, but because they don’t want to.

Competitors pursuing pure feature competition or price competition miss this entirely. They’re competing in a domain where differentiation is temporary and margins are commoditized. 15Five is competing in a domain where differentiation is sticky and margins are defensible.

Pillar Three: Extraordinary Customer Experiences as Strategic Multiplier

The third pillar—aligning around extraordinary customer experiences—represents the convergence point where internal excellence and relationship capital translate into market differentiation.

Most software companies define success as meeting specifications. The customer contracted for specific features; the vendor delivered them. Success criterion met. This transactional framing misses the opportunity to create delight.

15Five operates from a different baseline. The organization asks: “What would it mean to exceed customer expectations so dramatically that they become advocates?” This question reframes product development, customer success, and even company strategy.

Extraordinary experiences emerge from organizational alignment. When the engineering team understands customer success metrics. When the support team influences product priorities. When executives regularly interact with customers. When employees across functions understand the connection between their work and customer outcomes—that’s when extraordinary experiences become systematic rather than accidental.

This alignment is exceptionally difficult to replicate. It requires cultural cohesion that’s expensive to build and fragile to maintain. Most organizations give up and settle for “good enough.” Those that persist find themselves competing in a completely different arena.

The competitive advantage here is multiplicative. Extraordinary experiences generate customer loyalty that drives word-of-mouth growth, which reduces customer acquisition costs. Positive customer experiences generate data that informs product roadmaps, which increases product-market fit. Engaged customers become advocates who influence their networks, creating network effects.

15Five’s growth trajectory reflects this dynamic. The company has achieved significant market presence not primarily through sales force expansion, but through customer advocacy and organic growth. This is the ultimate vindication of values-driven strategy.

The Operational Architecture of Values

Understanding how 15Five translates values into operational reality is essential for competitors examining their own strategic positioning.

Values create competitive advantage only when they’re operationalized. This requires several components working in concert.

First, values must be specific and measurable. “Build trusted relationships” is aspiration. “Achieve X% customer satisfaction scores and maintain < Y% voluntary churn” is operational. 15Five’s success stems partly from having moved beyond mission statements into measurable commitments.

Second, leadership must be relentlessly consistent. Culture scales in organizations where every senior leader demonstrates values consistently. When the CEO prioritizes customer relationships, the organization follows. When the VP of Engineering allocates resources to user experience improvement, the organization follows. When managers conduct 1-on-1 development conversations, the organization follows. Inconsistency at the top cascades downward rapidly.

Third, systems must reinforce values. Performance evaluation systems must measure contribution to customer outcomes, not just individual output. Compensation systems must reward behaviors aligned with values, not just revenue generation. Technology platforms (like 15Five itself) must make values-aligned behaviors easy and values-misaligned behaviors difficult.

Fourth, hiring must be ruthlessly aligned. It’s possible to hire talented individuals who don’t share organizational values. These hires create cultural drag. They signal to the organization that achievement trumps alignment. They undermine everything else you’re building. The most valuable hiring discipline is rejecting talented candidates who don’t demonstrate values alignment.

Competitive Vulnerability and the Cost of Values

This is where rigorous analysis becomes critical. Values-driven strategy has genuine costs and vulnerabilities that merit examination.

The most obvious cost is decision-making speed. Values-driven organizations often move slower than competitors because more stakeholders are involved in decisions. If you’re genuinely committed to building trusted relationships internally, you consult. You debate. You ensure alignment. This takes time. In certain market conditions—existential competitive threats, fast-moving windows of opportunity—this deliberation can be costly.

The second cost is organizational complexity. Values-driven cultures require more leadership attention per capita than transactional cultures. You’re investing substantially in people development, trust-building, and alignment. Competitors with lower cost bases can sometimes undercut you on price while still maintaining acceptable margins. This is particularly dangerous in commoditized markets where price becomes the primary differentiator.

The third vulnerability is execution risk. Values-driven organizations bet heavily on cultural cohesion. If that cohesion breaks—through rapid scaling, failed leadership, or strategic misdirection—the organization can unravel quickly. The same cultural advantages that created competitive strength can amplify cultural weaknesses if they develop.

15Five has navigated these challenges partially through focus. The company operates in a specific market segment (mid-market to enterprise organizations) where price sensitivity is moderate and relationship capital is valued. It hasn’t tried to compete on price with bare-bones competitors. It hasn’t pursued product line extensions that would dilute cultural focus. This discipline reduces some vulnerabilities.

The 2026 Context: Why Values Matter More Than Ever

Several macro trends in 2026 make values-driven strategy particularly relevant for industry players.

Economic Uncertainty. In uncertain environments, customers gravitate toward vendors they trust. Commodity products with low switching costs become vulnerable. Relationships become more valuable. 15Five benefits from this dynamic because its competitive advantage is relational, not purely functional.

Talent Disruption. The knowledge worker market remains dramatically constrained. Competition for engineering talent is ferocious. Organizations that genuinely commit to employee development and psychological safety maintain talent at rates that surprise industry observers. Values-driven organizations have structural advantages in talent acquisition and retention that translate to operational advantages.

Regulatory Escalation. As governments increasingly regulate AI, data privacy, and worker treatment, values-driven organizations face fewer compliance costs. They’ve already aligned operations with principles that regulators eventually mandate. Competitors who’ve optimized purely for profit face expensive pivots as regulatory requirements shift.

Customer Sophistication. Enterprise customers in 2026 are far more sophisticated about vendor evaluation. They conduct reference calls, examine Glassdoor reviews, and assess company values alignment with their own organizational principles. Vendors without genuine values alignment face harder sales conversations and higher churn rates.

Network Effects. Values-driven organizations that build advocacy-based growth models access network effects that pure feature competition can’t match. When growth is driven by customer recommendations rather than sales force expansion, unit economics improve substantially and growth becomes increasingly efficient.

Strategic Implications for Competitors

For organizations competing in spaces where 15Five operates, or in adjacent markets, several strategic implications warrant serious consideration.

First, values must be authentic. Customers and employees are sophisticated enough to detect performative values. If your organization’s stated values contradict observable behavior, you’re creating liability rather than advantage. This means a genuine audit: What do we actually believe? What are we actually willing to sacrifice for? What does consistency with those beliefs require?

Second, build from strength. Don’t attempt to replicate 15Five’s entire values framework. Identify which values are authentic to your organization and which could genuinely drive competitive advantage given your market position. Authentic differentiation beats imitation every time.

Third, operationalize ruthlessly. Values exist as competitive advantages only when they’re embedded in systems, processes, hiring, compensation, and leadership behavior. High-level commitment without operational embedding is theater.

Fourth, accept the cost-benefit tradeoffs. Values-driven strategy excels in relationship-intensive markets with educated customers and competitive labor markets. It may not be optimal in commoditized markets with price-sensitive customers. Be honest about whether your market structure rewards values-based differentiation.

Fifth, measure relentlessly. If you can’t measure the business impact of values-driven strategy, you can’t justify continued investment. Create dashboards that connect cultural metrics (engagement, retention, psychological safety) to business metrics (customer satisfaction, churn, NPS, growth rate). This connection is what separates strategy from sentiment.

The Longer Arc: Values as Organizational Infrastructure

Stepping back from tactical considerations, values-driven strategy represents a fundamental shift in how organizations should think about competitive advantage in knowledge-intensive industries.

For decades, competitive advantage came from proprietary technology, patents, economies of scale, or network effects. These remain important, but they’re increasingly replicable. A sufficiently well-funded competitor can eventually match your technology. Patents expire. Scale can be achieved by better-capitalized competitors. Network effects require early-mover advantage and can be disrupted by superior user experience.

Values, by contrast, create advantages that are genuinely difficult to replicate. You can’t simply decide to have a values-driven culture; you must build it, protect it, and reinforce it constantly. You can’t hire values alignment; you must identify it and cultivate it. You can’t outsource culture; it lives in thousands of daily interactions and decisions.

This creates what business strategists call “competitive moats”—sustainable advantages that protect the core business from disruption. 15Five has constructed multiple moats simultaneously: relationship capital, employee engagement, customer advocacy, and product quality. Competitors attempting to dislodge 15Five face the challenge of not just building better products, but replicating an entire organizational approach.

Conclusion: The Thesis Restated

The central argument here is straightforward but consequential: In 2026, values-driven organizations possess structural competitive advantages in relationship-intensive, knowledge-intensive industries. These advantages are neither accidental nor mystical. They emerge from deliberate operational choices, consistent leadership, aligned systems, and ruthless authenticity.

15Five exemplifies this approach without inventing it. The principles apply across industries: healthcare, professional services, financial advisory, management consulting, enterprise software, and others where human relationships and expertise dominate value creation.

For industry peers and competitors, the question isn’t whether to adopt values-driven strategy wholesale, but rather whether your current strategy adequately captures the competitive value of genuine values alignment. The market is increasingly answering this question for you. Customers reward vendors who deliver on stated values. Employees reward employers who live their missions. Investors reward companies with sustainable competitive advantages.

15Five’s success isn’t despite its values focus; it’s substantially because of it. Understanding this distinction—and acting on it—represents the strategic work of the next phase of organizational competition.

The companies that do this work will build the durable advantages that define industry leadership in the coming decade. Those that don’t will find themselves competing on increasingly commoditized terrain, where margins compress and growth becomes exhausting.

The choice, ultimately, belongs to each organization. But the competitive implications of that choice have never been clearer.