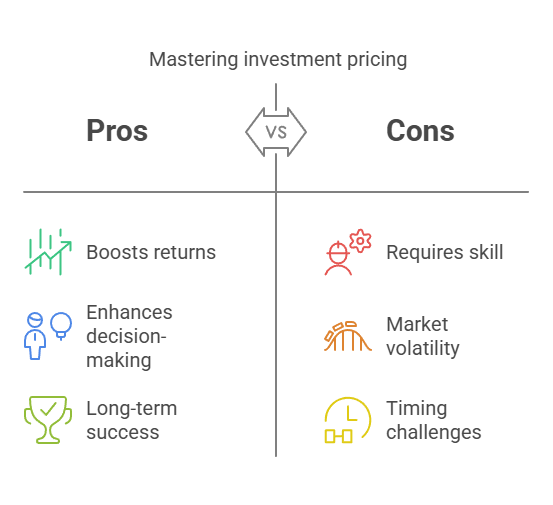

Is Buying and Selling at the Right Price the Ultimate Investment Skill? Here’s Why It Matters

Buying and Selling at the Right Price

Introduction: The Power of the Right Price in Investment

When it comes to investing, one thing often stands out as a game-changer: buying and selling at the right price. But why does it matter so much? After all, investors are often told that it’s not just about the price—it’s about timing, market trends, and knowing the right moment to enter or exit. But truth be told, pricing is the bedrock of successful investments. The skill of knowing when a stock, property, or asset is priced well can dramatically boost your returns or, conversely, lead to disappointing outcomes. So, let’s dive into why mastering this skill could be the secret to long-term financial success.

Buying and Selling at the Right Price

What Is Investment Pricing?

Before we get too deep, let’s clarify: investment pricing is the process of determining the current or potential future value of an asset. This can apply to stocks, bonds, real estate, or even businesses. Essentially, it’s about understanding how much you’re willing to pay for something based on its projected returns and overall value in the market. Without proper pricing, you risk making poor decisions that could cost you.

Why Getting the Right Price is Crucial in Investments

The old adage “buy low, sell high” is simple yet powerful. But what does it mean in practice? Getting the right price is directly linked to profitability. If you buy at an inflated price or sell too early, you could lose potential gains. On the other hand, purchasing at the right price—and waiting for market conditions to shift in your favour—can lead to impressive returns. It’s all about making that right call between underpricing and overpricing.

How Market Timing Plays a Role in Pricing

Timing and pricing go hand in hand. Let’s say you’re looking to buy a stock or a piece of real estate. Timing is everything. If you buy at the peak of the market, you might be overpaying, only to see the price drop soon after. On the other hand, if you wait for a market dip or correction, you could acquire assets at a much better price. Market timing, while often debated, plays a huge role in determining whether you’re able to buy or sell at the “right price.”

The Importance of Patience in Investment Pricing – Buying and Selling at the Right Price

Patience is another key ingredient in getting the price right. It’s easy to get swept up in market hype and make impulsive decisions. But the best investors know that waiting for the right price is sometimes the smartest move. While the market may fluctuate, having the discipline to wait for the right moment can make all the difference. Patience allows you to weather market downturns and wait for assets to reach more favourable pricing levels.

Identifying Market Trends and Predicting the Right Price

To excel at buying and selling at the right price, you need to be able to read the market trends. Is the market in an uptrend? Is it peaking or in decline? By spotting patterns in the market and understanding technical indicators, you can predict when prices will likely rise or fall. Predicting market movements isn’t fool proof, but it definitely improves your odds of getting in or out of a market at the right price.

Overpaying: The Hidden Risk of Bad Investment Decisions – Buying and Selling at the Right Price

Overpaying for an asset is one of the quickest ways to diminish your potential returns. When you pay more than an asset is worth, you set yourself up for disappointment. Over time, these types of decisions can really add up. That’s why it’s crucial to learn how to properly assess whether you’re paying a fair price for the asset in question.

Undervaluation: The Potential for High Returns

On the flip side, finding undervalued assets can be a goldmine for investors. By identifying an asset that’s priced below its intrinsic value, you position yourself to see substantial gains when the market corrects and the value rises. Knowing how to spot undervalued opportunities can be the difference between making a good return and missing out on an incredible investment.

Psychological Factors in Pricing Decisions – Buying and Selling at the Right Price

As much as we like to think we’re objective, emotions often play a significant role in investment pricing decisions. Fear, greed, and even overconfidence can cloud your judgment and lead to irrational decisions. Investors must be aware of these psychological biases and avoid letting them dictate their choices when determining the right price to buy or sell.

Common Mistakes Investors Make When Pricing Investments – Buying and Selling at the Right Price

There are a few key mistakes investors often make when setting or evaluating prices. One common mistake is failing to consider the long-term value of an asset and focusing too much on short-term fluctuations. Others let emotions drive their decisions—like panic-selling in a downturn or greedily chasing prices during a market rally. Recognizing these mistakes early on can save you from costly missteps.

How to Develop the Skill of Buying and Selling at the Right Price

So, how do you master the skill of buying and selling at the right price? Start by building knowledge about the market and different asset types. Read books, follow expert analysis, and stay informed. Experience also plays a huge role. Over time, you’ll develop a better instinct for when prices are right. Keep learning and applying those lessons to future investments.

Case Studies of Successful Investors Who Mastered Pricing – Buying and Selling at the Right Price

A great example of someone who mastered pricing is Warren Buffett. He’s famous for buying undervalued companies at the right time and holding them until their full potential is realized. By focusing on the long-term value of investments, Buffett has consistently made profitable deals. His approach teaches us that patience and a deep understanding of intrinsic value are crucial.

Tools and Resources for Improving Your Investment Pricing Skills

There are many tools that can help you refine your pricing skills. From stock screeners and valuation calculators to investment research platforms like Bloomberg and Morningstar, the right resources can give you a huge advantage. Courses, books, and seminars can also teach you advanced strategies for evaluating price and market timing.

How Technology is changing the Way We Price Investments – Buying and Selling at the Right Price

In today’s world, technology is revolutionizing how investors approach pricing. AI and machine learning algorithms can now predict price movements with incredible accuracy. These tools help investors analyse vast amounts of data in seconds, making it easier to spot the right price to buy or sell.

Conclusion: Mastering the Art of Investment Pricing for Success

In conclusion, knowing how to buy and sell at the right price is one of the most important skills an investor can have. It requires patience, knowledge, and a good understanding of market trends. But with the right tools and mind-set, anyone can learn how to price investments effectively and set themselves up for long-term success.

FAQs – Buying and Selling at the Right Price

- What is the best way to know if I’m buying an investment at the right price?

- The best way is to analyse the asset’s intrinsic value, its market history, and its growth potential. Use tools like valuation metrics, financial ratios, and market comparisons to ensure you’re paying a fair price.

- How does market volatility impact the decision to buy or sell at the right price?

- Market volatility can make short-term price movements unpredictable. However, by focusing on long-term trends and the fundamental value of an asset, investors can better time their buy and sell decisions to avoid overpaying or selling too early.

- Is it possible to always buy low and sell high?

- While it’s the goal of every investor, buying low and selling high is difficult to execute consistently. It requires deep market understanding, timing, and the ability to resist emotional impulses.

- What should I do if I realize I overpaid for an investment?

- If you overpaid for an investment, resist panic. Assess whether the asset still holds long-term potential, and consider holding it until the market catches up with its value. Sometimes, patience can turn an overpaid investment into a profitable one.

- How do I spot undervalued assets that could yield high returns?

- Look for assets with low market prices despite strong fundamentals. This could include companies with robust earnings, assets in growing industries, or undervalued stocks that have strong potential for growth but are temporarily overlooked by the market.

- How do psychological biases affect my investment decisions about price?

- Biases like loss aversion, anchoring, or herd behaviour can cause you to overvalue or undervalue investments based on emotions rather than facts. Being aware of these biases can help you make more rational pricing decisions.

- Why is it important to avoid emotional decisions in investment pricing?

- Emotional decision-making can lead to impulsive buying or selling, causing you to overpay for assets or sell prematurely. Staying calm and relying on logical analysis helps ensure you buy and sell at the right price.

- How can I improve my skills in pricing investments correctly?

- To improve, focus on learning key financial metrics, market trends, and valuation techniques. Practice through analysis, use investment research tools, and study successful investors who mastered the art of pricing.

- Is timing the market important, or should I just focus on the price?

- Both market timing and pricing are important. Understanding market conditions helps you determine the optimal price to buy or sell. However, timing is challenging, so it’s often more about understanding value and making decisions based on long-term growth.

- Can technology help in determining the right investment price? . Yes, technology plays a significant role. Tools such as AI-powered financial analysis platforms, algorithmic trading, and real-time data can assist in identifying the right investment price by analysing market trends, price patterns, and company fundamentals efficiently.

Thank you for reading this blog. Please share your feedback

This blog is not financial advise. Please do research and read investment documents before you take decision.

One Comment