The Green Aluminum Revolution: Niche Business Ideas for Sustainable-Minded Entrepreneurs in 2025

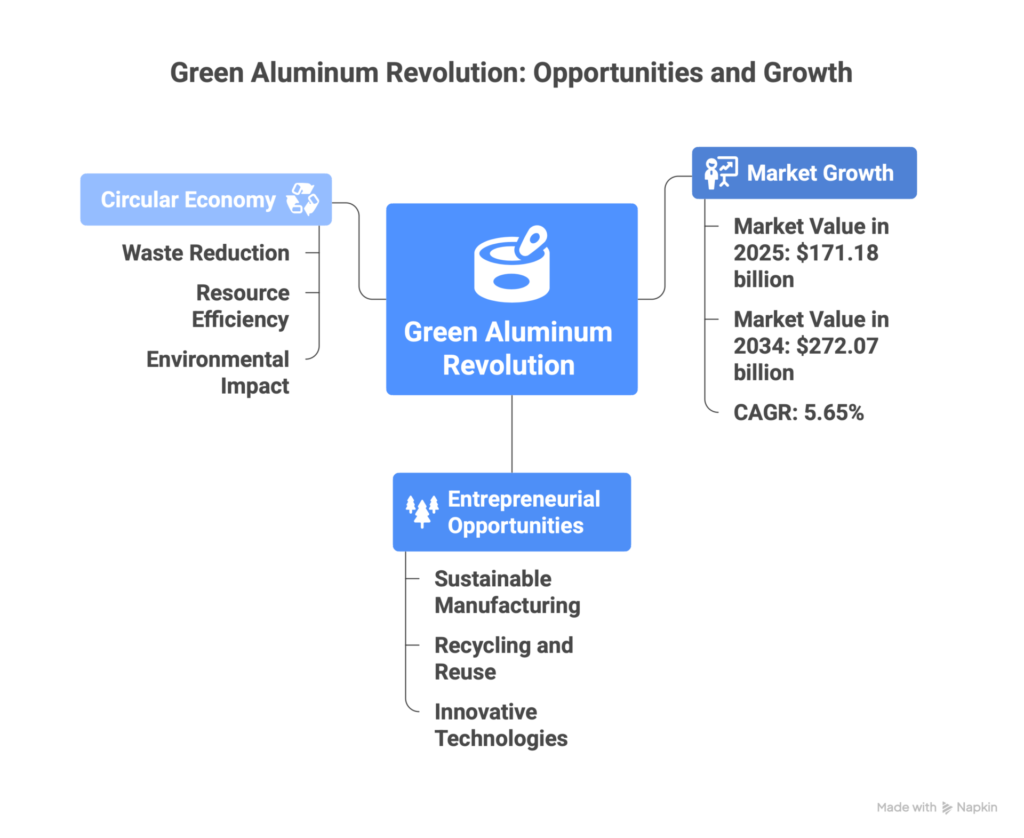

The aluminum industry stands at a transformative crossroads in 2025, where environmental imperatives and economic opportunities converge to create the “green aluminum revolution.” As global markets shift toward sustainability, entrepreneurs now have unprecedented opportunities to build profitable businesses that align with the circular economy while addressing one of manufacturing’s most carbon-intensive sectors. With the global green aluminum market valued at $171.18 billion in 2025 and projected to reach $272.07 billion by 2034, growing at a CAGR of 5.65%, sustainable-minded business owners have a unique window to establish themselves in this burgeoning sector.

Understanding the Green Aluminum Landscape

Green aluminum represents a fundamental reimagining of how the metal is produced, processed, and circulated through the economy. Unlike conventional aluminum production, which contributes 3-4% of total greenhouse gas emissions in countries like Australia, green aluminum leverages renewable energy, advanced recycling technologies, and innovative smelting methods to dramatically reduce its carbon footprint. The production of traditional aluminum typically generates 12-16 tons of CO₂ per ton of metal, but certified low-carbon varieties can achieve emissions as low as 1.97-4.0 kg CO₂e per kg aluminum.

This transformation is driven by multiple forces: stringent environmental regulations like the EU’s Carbon Border Adjustment Mechanism (CBAM), which will impose tariffs on high-carbon aluminum imports starting in 2026, consumer demand for sustainable products, and corporate commitments to net-zero emissions. India, the world’s second-largest aluminum producer, has committed to achieving net-zero emissions by 2070, with medium-term targets of reducing emissions to 4-5 tons of CO₂ per ton of aluminum. These policy frameworks create both pressure and opportunity for entrepreneurs willing to innovate within the green aluminum ecosystem.

High-Impact Business Opportunities in the Green Aluminum Revolution

Aluminum Recycling Plant Operations

Aluminum recycling represents one of the most accessible and profitable entry points for sustainable entrepreneurs. The economics are compelling: recycled aluminum requires only 5% of the energy needed to produce primary aluminum and results in just 5% of the associated carbon emissions. With approximately 67% of aluminum cans currently recycled globally, significant room exists for entrepreneurs to capture the remaining 33% while building profitable operations.

Starting an aluminum recycling plant requires between ₹18-35 lakh for equipment and setup, with space requirements as modest as 3,000-3,400 square feet. The business model involves collecting aluminum scrap from various sources—beverage cans, automotive parts, construction waste, and industrial offcuts—then processing it through shredding, melting, and casting into ingots or billets for resale. India’s aluminum scrap market alone stands at over ₹31,160 crores and is projected to grow to ₹91,840 crores by 2034.

Essential infrastructure includes shredding machines, melting furnaces (preferably induction furnaces with AI-supported process control that can reduce energy consumption by up to 20%), casting equipment, and sorting systems. Entrepreneurs must obtain licenses including GST registration, factory licenses, NOC from the State Pollution Control Board, and MSME registration. Strategic location near industrial hubs like Gujarat, Maharashtra, or Tamil Nadu optimizes logistics and reduces operational costs.

The profitability margins in aluminum recycling are substantial, with estimates ranging from 70-100%. Modern facilities can process 300-420 kg per hour with semi-automatic equipment, scaling up to 5-30 tons per hour with fully automated systems. Entrepreneurs can differentiate themselves by developing closed-loop partnerships with manufacturers who guarantee both scrap supply and purchase agreements for recycled material, creating predictable revenue streams.

Closed-Loop Aluminum Supply Chain Consulting – Green Aluminum

As corporations face mounting pressure to achieve net-zero targets and comply with regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD), a massive demand exists for consultants who can design and implement closed-loop aluminum systems. This business model involves helping manufacturers, construction companies, and automotive firms establish circular aluminum flows where materials are continuously reused without quality degradation.

Entrepreneurs in this space provide services including supply chain mapping, scrap collection system design, partnership brokering between scrap suppliers and manufacturers, and implementation of tracking technologies for material traceability. The service can extend to helping companies achieve certifications like the Aluminium Stewardship Initiative (ASI) Chain of Custody standard, which guarantees materials are tracked through every production step.

Revenue models include project-based consulting fees, percentage commissions on material flows facilitated, and ongoing retainer agreements for supply chain optimization. With aluminum’s infinite recyclability and closed-loop recycling potentially saving 60 million tonnes of greenhouse gas emissions annually by 2030, companies will pay premium rates for expertise that helps them capture these environmental and economic benefits.

Success factors include developing expertise in ASI, Carbon Trust, and Hydro REDUXA certification frameworks, building networks with both scrap aggregators and manufacturers, and staying current on regional regulatory requirements. Consultants who can demonstrate measurable carbon footprint reductions and cost savings will command the highest fees in this expanding market.

Certified Low-Carbon Aluminum Trading and Brokerage – Green Aluminum

The emergence of distinct price signals for low-carbon aluminum creates lucrative opportunities for specialized traders and brokers. In 2025, Platts expanded its Low-Carbon Aluminium Price (LCAP) and Zero-Carbon Aluminium Price (ZCAP) assessments to provide transparent benchmarking, establishing low-carbon aluminum as a tradable commodity class with measurable premiums over standard aluminum.

Entrepreneurs can establish trading operations that connect certified low-carbon aluminum producers with buyers in automotive, packaging, electronics, and construction sectors who face regulatory pressure or have made sustainability commitments. The business model involves sourcing aluminum with verified carbon intensity below key thresholds (typically 4 kg CO₂e per kg for low-carbon designation), facilitating transactions, and capturing margins on the price differential between standard and certified aluminum.

Key differentiators include developing relationships with certified producers like Hydro (REDUXA and CIRCAL brands), Alcoa (EcoSource and Sustana), Vedanta (Restora and Restora Ultra), and RUSAL (ALLOW brand), understanding regional certification requirements, and providing carbon accounting services that help buyers meet Scope 3 emissions reporting obligations. Traders who can bundle physical aluminum supply with carbon credit offsets for zero-carbon certification will command additional premiums.

The market opportunity is substantial: European automakers like Audi and BMW already prioritize REDUXA-certified aluminum to avoid CBAM tariffs, while Asian markets are developing similar low-carbon premiums. Starting capital requirements are moderate, primarily involving working capital for inventory and establishing creditworthiness with producers and buyers.

Aluminum Scrap Aggregation and Sorting Networks – Green Aluminum

Between traditional recycling and waste collection lies a profitable opportunity: establishing professional aluminum scrap aggregation networks that collect, sort, and supply high-quality feedstock to recycling facilities. With approximately 65-70 billion aluminum cans ending up in landfills annually, representing $1 billion in lost value in the United States alone, systematic collection systems can capture significant value.

This business model involves creating collection networks through partnerships with local scrap dealers (“kabadiwalas” in India), construction sites, manufacturing facilities, auto repair shops, and e-waste dealers. The entrepreneur’s value proposition is providing consistent volumes of sorted, clean aluminum scrap rather than mixed waste, commanding premium pricing from recyclers who save processing costs.

Advanced operations can incorporate sorting technologies like LIBS (Laser-Induced Breakdown Spectroscopy) equipment, similar to Hydro’s joint venture with PADNOS that sorts approximately 20,000 tonnes of end-of-life aluminum annually. This technology enables “deep diving” into mixed scrap to recover aluminum that would otherwise be landfilled or exported, sorting by alloy type to maximize value.

Revenue streams include margins on scrap sales, collection fees from commercial clients, and potentially processing fees for sorting services. Investment requirements include collection vehicles, storage facilities, basic sorting equipment, and digital inventory management systems. Location strategy should focus on high-generation areas like metropolitan regions with significant beverage consumption, active construction markets, or automotive manufacturing clusters.

Entrepreneurs can differentiate by offering pickup services, providing transparent weighing and pricing, offering higher rates than traditional kabadi systems, and establishing monthly payment arrangements with regular commercial suppliers. As recycling rates target 80% by 2030 and nearly 100% by 2050, well-positioned aggregation networks will benefit from both volume growth and increasing scrap values.

Aluminum Foam Manufacturing for Niche Applications – Green Aluminum

Aluminum foam, a lightweight porous material with unique properties including excellent energy absorption, fire resistance, and acoustic dampening, represents a high-margin niche opportunity. The global aluminum foam market is projected to reach $55 million by 2027, driven by demand in automotive crash absorption systems, construction fire protection, aerospace components, and acoustic insulation applications.

Entrepreneurs can establish aluminum foam production using several methods: the stabilized aluminum foam process pioneered by Cymat (involving injecting gas into molten aluminum stabilized with ceramic particles), powder metallurgy approaches using aluminum powder mixed with foaming agents, or direct foaming techniques. Capital requirements vary significantly by production method, with basic furnace-based setups starting around ₹18-35 lakh and scaling to more sophisticated operations for specialized applications.

Key market opportunities include lightweight structural panels for construction cladding and interior applications (aluminum foam can reduce weight by 80% compared to solid aluminum), energy-absorbing anti-intrusion bars for automotive safety systems, fire-resistant panels for industrial applications, and specialized heat exchangers for electronics cooling. The construction sector offers particularly strong growth potential as international building codes increasingly emphasize sustainability and energy efficiency.

Success factors include developing proprietary foam formulations for specific applications, establishing partnerships with end-users in construction, automotive, or aerospace sectors, obtaining necessary quality certifications, and continuous R&D to control pore size, shape, and density—critical parameters that determine final properties. Entrepreneurs with materials science backgrounds or partnerships with technical institutions will have significant advantages in this technically sophisticated market.

Green Hydrogen-Powered Aluminum Processing Services – Green Aluminum

One of the most forward-looking opportunities in the green aluminum revolution involves establishing processing facilities powered by green hydrogen rather than fossil fuels. Major aluminum producers including Hydro, Constellium, and Rio Tinto have successfully conducted industrial trials using hydrogen in high-heat melting operations, demonstrating technical feasibility while achieving dramatic emissions reductions—up to 500,000 tonnes of CO₂ annually at scale.

Entrepreneurs can position themselves as specialized processors offering green hydrogen-powered melting, casting, or heat treatment services to aluminum manufacturers and fabricators seeking to decarbonize their operations. The value proposition is providing certified low-carbon processing that helps clients meet emissions targets and qualify for green aluminum certifications without requiring them to invest in hydrogen infrastructure themselves.

Hydro’s successful trial in Navarra, Spain produced over 100 tons of billet in various aluminum alloys using hydrogen or hydrogen-natural gas blends, with no significant productivity losses, no major quality impacts, and no safety incidents. Constellium completed its first industrial-scale casting using hydrogen in a 12-ton furnace in July 2024, producing aluminum slabs that were processed into automotive sheet for electric vehicles.

Initial setup requires significant capital investment in hydrogen-compatible furnaces (such as regenerative burners capable of using pure hydrogen or blended fuels), hydrogen supply infrastructure or on-site generation, and comprehensive safety systems. However, government subsidies for green hydrogen adoption, carbon credits for emissions reductions, and premium pricing for low-carbon processing services can provide attractive return on investment timelines.

Target markets include automotive component manufacturers under pressure to reduce embodied carbon in electric vehicles, aerospace suppliers requiring lightweight low-carbon materials, and architectural aluminum processors serving green building projects. As green hydrogen infrastructure expands and costs decline, early-mover processing facilities will establish market leadership and benefit from economies of scale.

Aluminum Packaging Circular Economy Systems – Green Aluminum

The packaging sector represents one of aluminum’s largest applications, with global demand for aluminum beverage cans projected to rise from 420 billion units in 2020 to 630 billion by 2030. Entrepreneurs can build businesses specifically focused on closing the loop in aluminum packaging through innovative collection, cleaning, and return systems.

One promising model involves establishing deposit-return infrastructure for aluminum packaging beyond traditional beverage cans. Companies like Ball Corporation are already investing in systems for personal care products where aluminum containers can be removed after use, recycled, and replaced with fresh containers. Entrepreneurs can develop localized versions of such systems for restaurants, hotels, catering services, or corporate campuses, providing collection logistics, cleaning services, and replacement supply.

Another approach involves becoming a specialized supplier of recycled-content aluminum packaging to small and medium food and beverage producers who lack direct relationships with major aluminum suppliers. By aggregating demand from multiple smaller brands and sourcing from certified recyclers producing material like Hydro’s CIRCAL (minimum 75% post-consumer recycled content) or Novelis’s high-recycled-content offerings, entrepreneurs can serve an underserved market segment while capturing margins on both procurement and sustainability consulting.

Revenue models include per-container collection fees, service agreements for reverse logistics, margins on recycled material supply, and consulting fees for helping brands communicate recycled content credentials to consumers. With aluminum cans being the least environmentally damaging single-use containers and recycled infinitely without property loss, brands increasingly seek partners who can help them maximize sustainability positioning.

Key success factors include establishing efficient collection logistics, developing cleaning and quality control systems, building relationships with certified recyclers, and creating tracking systems that provide transparency for marketing claims. Entrepreneurs who can provide turnkey circular systems will benefit from both environmental impact and strong unit economics.

Specialty Aluminum Alloy Upcycling – Green Aluminum

While traditional recycling simply remelts and reuses aluminum, advanced upcycling transforms lower-grade aluminum scrap into higher-value specialty alloys through innovative solid-phase processing. Recent research has demonstrated that low-strength 6063 aluminum scrap can be upcycled into high-performance 7075-equivalent alloys with yield and tensile strength increased by over 200% through friction extrusion processes that incorporate copper, zinc, and magnesium without melting.

Entrepreneurs with materials science expertise can establish specialized upcycling facilities that accept low-value aluminum scrap and produce premium-priced specialty alloys for aerospace, defense, automotive performance applications, and high-end sporting goods. The business model leverages severe plastic deformation techniques like friction stir processing or equal channel angular pressing to achieve nanocluster strengthening and refined microstructures that cannot be obtained through conventional melting and casting.

The value proposition is substantial: converting abundant low-grade aluminum scrap (often selling at commodity prices) into specialty alloys commanding 3-5x premiums while consuming less energy than traditional melting routes. Target customers include manufacturers requiring small to medium quantities of specialized aluminum alloys who currently pay high prices for virgin specialty material.

Initial investment requirements include specialized processing equipment (friction stir welding/processing systems, extrusion presses capable of severe deformation), materials characterization capabilities (mechanical testing, microscopy), and R&D partnerships with metallurgical institutions. Regulatory certifications for aerospace or automotive applications require significant investment but create substantial barriers to entry that protect margins.

Success depends on developing proprietary processing recipes for different scrap feedstocks and target alloys, establishing quality assurance systems meeting aerospace standards, and building customer relationships in industries that value material performance over cost. As additive manufacturing techniques like 3D printing with aluminum powders expand, upcycling operations could also produce specialty powders from scrap, accessing even higher-value markets.

ASI Certification Consulting and Training Services – Green Aluminum

As the Aluminium Stewardship Initiative (ASI) becomes the gold standard for responsible aluminum production and sourcing, demand surges for consultants who can guide companies through the certification process. With over 250 companies from more than 40 countries already participating in the ASI ecosystem, and regulatory frameworks increasingly requiring verified sustainability credentials, this consulting niche offers low-capital, high-margin opportunities.

Entrepreneurs can establish practices specializing in preparing aluminum producers, fabricators, and end-users for ASI Performance Standard certification (covering environmental, social, and governance criteria across the aluminum lifecycle) and Chain of Custody certification (ensuring materials are tracked and verified through every production step). Services include conducting gap analyses against ASI standards, developing implementation roadmaps, establishing documentation systems, training staff, and coordinating third-party audits.

Revenue models include fixed-fee consulting projects (typically ranging from ₹5-25 lakhs depending on facility size and complexity), ongoing compliance retainer agreements, training workshops for industry associations, and success fees tied to achieving certification. Additional services can include Carbon Trust certification consulting, helping clients qualify for low-carbon pricing premiums, and advising on CBAM compliance strategies for European exports.

The market extends beyond large aluminum producers to include fabricators, automotive suppliers, construction companies, and packaging manufacturers throughout the supply chain who require ASI Chain of Custody certification to supply to major brands like Apple, Audi, BMW, and others requiring verified sustainable aluminum. Small and medium enterprises particularly need external expertise as they typically lack in-house sustainability professionals.

Key success factors include obtaining deep knowledge of ASI standards and audit processes, building relationships with ASI-accredited auditors, developing case study portfolios demonstrating successful certifications, and staying current on evolving sustainability regulations. Consultants who can demonstrate clear ROI through access to premium markets, green financing, and regulatory compliance will command premium fees in this expanding sector.

Aluminum Craft and Upcycling Product Lines – Green Aluminum

At the intersection of sustainability and creative entrepreneurship lies the opportunity to build businesses converting aluminum waste into consumer products through artistic upcycling. Unlike industrial recycling, craft upcycling requires minimal capital investment while creating unique, high-margin products that appeal to environmentally conscious consumers willing to pay premium prices for artisanal sustainable goods.

Entrepreneurs can develop product lines including jewelry made from aluminum can tabs and colored can sections, decorative items like flowers and sculptures created from cut and shaped beverage cans, functional household items such as punched lanterns and coasters, garden accessories including weather-resistant plant markers and decorative pieces, and fashion accessories like bags and wallets incorporating aluminum materials.

The business model leverages essentially free raw materials (discarded beverage cans, food containers, and industrial scrap), minimal equipment requirements (cutting tools, sanders, punches, basic metalworking equipment), and direct-to-consumer sales channels including online marketplaces, craft fairs, boutique retail partnerships, and social media platforms. Production can start as a home-based operation and scale according to demand.

Key differentiators include developing signature design aesthetics, emphasizing the sustainability narrative in marketing, creating instructional content that builds community engagement, and potentially offering workshops or DIY kits as additional revenue streams. Successful operations can expand into B2B markets supplying corporate gifts for companies seeking sustainable promotional items or partnering with restaurants and hospitality businesses for unique decor elements.

Market research indicates strong consumer interest in upcycled products, particularly among millennial and Gen Z demographics who prioritize sustainability and uniqueness. Pricing strategies should reflect the artisanal nature and sustainability credentials rather than competing on commodity pricing—well-executed pieces can command multiples of material cost based on design value and environmental story.

Implementation Strategies for Success – Green Aluminum

Regardless of which green aluminum business opportunity entrepreneurs pursue, several common success factors apply across the sector. First, staying rigorously informed about evolving regulations—particularly the EU’s CBAM, India’s net-zero roadmap, and emerging ESG disclosure requirements—enables proactive positioning rather than reactive compliance. Second, building verifiable sustainability credentials through recognized certifications like ASI, Carbon Trust, or product-specific programs establishes credibility and commands premium pricing.

Third, developing strong B2B partnerships throughout the value chain creates competitive advantages and stable revenue streams. Whether connecting scrap suppliers with recyclers, processors with manufacturers, or certified material suppliers with brand companies under sustainability pressure, entrepreneurs who facilitate ecosystem connections capture ongoing value. Fourth, investing in appropriate technology—whether advanced sorting equipment, hydrogen-compatible furnaces, or digital tracking systems—delivers operational efficiency and quality differentiation.

Fifth, accessing available government support through programs like India’s Startup India initiative, Make in India subsidies, and potential green aluminum production credits similar to Australia’s $2 billion program can dramatically improve project economics and de-risk early-stage operations. Sixth, developing compelling sustainability narratives supported by verified metrics enables effective marketing to both B2B customers seeking supply chain decarbonization and B2C consumers prioritizing environmental responsibility.

Conclusion – Green Aluminum

The green aluminum revolution of 2025 represents a rare convergence of environmental necessity, regulatory momentum, technological readiness, and market demand that creates exceptional opportunities for sustainable-minded entrepreneurs. Whether establishing recycling operations that reduce emissions by 95% compared to primary production, providing consulting services that help corporations achieve net-zero targets, trading certified low-carbon aluminum commanding measurable premiums, or building innovative product lines from upcycled materials, multiple pathways exist for building profitable businesses aligned with circular economy principles.

The sector’s growth trajectory—with the green aluminum market expanding from $171 billion to $272 billion between 2025 and 2034—ensures expanding opportunities as sustainability transitions from optional to mandatory across industries. Entrepreneurs who enter now, develop recognized expertise, establish strong ecosystem partnerships, and build verified sustainability credentials will position themselves as essential partners in the aluminum industry’s transformation toward environmental responsibility. As governments worldwide tighten emissions regulations, corporations accelerate net-zero commitments, and consumers increasingly preference sustainable products, green aluminum businesses will benefit from sustained tailwinds across regulatory, economic, and social dimensions.

The time for sustainable-minded entrepreneurs to act is now. The green aluminum revolution is not a distant future—it is the present reality of an industry in fundamental transformation, offering those with vision, commitment, and strategic execution the opportunity to build businesses that are simultaneously profitable, scalable, and genuinely beneficial for planetary health.

One Comment