Empowering Local Enterprises: How ONDC is Reshaping India’s Digital Commerce Landscape 2026

Introduction: A Paradigm Shift in Digital Commerce

The Indian retail landscape is undergoing a profound transformation. For decades, small shopkeepers, artisans, and local entrepreneurs have watched helplessly as massive e-commerce conglomerates captured the digital marketplace, dictating terms, extracting hefty commissions, and controlling customer visibility through opaque algorithms. Today, a government-backed initiative is fundamentally changing this power dynamic—and it’s called the Open Network for Digital Commerce (ONDC).

This isn’t just another digital platform. ONDC represents a philosophical departure from centralized marketplace models. It’s an open, interoperable ecosystem designed to democratize e-commerce, giving local businesses the autonomy, affordability, and market access that was previously the exclusive privilege of large corporations.

Consider the numbers: As of January 2026, ONDC has facilitated over 350 million transactions, with daily volumes reaching 5-6 lakh transactions by May 2025. More remarkably, the network is projected to scale from these figures to nearly 60 lakh daily transactions by the end of 2026—representing a 10-fold increase. This explosive growth isn’t coincidental. It reflects a genuine shift in how Indian businesses and consumers view digital commerce, and it’s primarily driven by small businesses recognizing an unprecedented opportunity.

For professionals working in procurement, finance, and business operations, understanding ONDC is increasingly essential. Whether you’re advising small vendors, evaluating procurement strategies, or exploring entrepreneurial opportunities, ONDC’s mechanics and implications deserve your attention. This article explores not just what ONDC is, but why it matters strategically for the Indian economy and how local businesses can leverage it effectively.

Understanding ONDC: Beyond the Buzz

What Makes ONDC Fundamentally Different

The Open Network for Digital Commerce operates on a principle that conventional e-commerce platforms reject: interoperability. Unlike Amazon or Flipkart, where sellers are locked into proprietary systems, ONDC creates an open protocol where multiple platforms, payment gateways, and logistics providers communicate seamlessly.

Think of it this way. In traditional e-commerce, the platform acts as a gatekeeper. It controls which products appear in search results, decides your commission rate, and can potentially penalize you by reducing visibility for policy violations—often without transparent appeal mechanisms. In ONDC, you maintain direct relationships with customers across multiple buyer applications simultaneously. A product listed on your ONDC storefront can be purchased through any ONDC-enabled buyer app, whether it’s Flipkart’s ONDC offering, a regional player, or an independent application.

This architectural difference has profound implications. It shifts bargaining power from platforms to businesses. It enables genuine competition because customers can compare prices across multiple seller applications within a single buyer interface. Most importantly for small businesses, it eliminates the vendor lock-in that has plagued digital commerce in India for over a decade.

The Technical Architecture: How Interoperability Works

For those familiar with procurement systems like SAP Ariba, ONDC’s approach will feel intuitive. It uses standardized API (Application Programming Interface) specifications, allowing diverse software systems to exchange information without proprietary integration fees or lengthy technical negotiations.

When you list a product on ONDC through an approved service provider, that listing becomes accessible across the entire network. A customer using any ONDC-compliant buyer app can discover your product, check real-time inventory, place an order, and process payment—all without you requiring a separate relationship with that buyer app. The network handles the translation between different systems automatically.

This interoperability extends beyond product listing. Logistics partners can optimize delivery routes across multiple sellers on ONDC. Payment gateways can process transactions from various buyer apps. Customer support systems can operate across the network. This is fundamentally different from traditional platforms, where each business must maintain separate integrations with each platform they wish to sell on.

The Economics of ONDC: Why Small Businesses Are Embracing It

The Commission Crisis in Traditional E-Commerce

Before examining ONDC’s benefits, it’s worth understanding the problem it’s solving. Traditional e-commerce platforms charge sellers anywhere from 8% to 30% commissions on each transaction, depending on product category and merchant tier. For a small grocer selling items with 15-20% margins, this effectively means surrendering 50% of profit just for the privilege of being visible online.

Consider a typical scenario: A neighborhood clothing store owner sells women’s apparel with a gross margin of 35%. On a platform like Amazon, category commissions run 15%, payment gateway fees add 2.5%, and logistics coordination charges another 2-3%. The store owner retains roughly 15% of revenue. After calculating rent, staff, and other overheads, profitability evaporates. This is precisely why so many small retailers remained offline until ONDC emerged.

As of January 1, 2025, ONDC introduced a nominal fee structure—₹1.5 per transaction (excluding taxes) for orders above ₹250. This represents roughly 0.3-0.6% of transaction value for most orders. For that same clothing store, this changes the economics entirely. Suddenly, going digital becomes viable for businesses operating on thin margins.

Real-World Impact: Stories of Transformation

The transformation isn’t theoretical. Kanchipuram saree weavers—among India’s most traditional artisans—exemplify this opportunity. A collective of nine sellers from Kanchipuram achieved ₹21 lakh in sales within just 10 months on ONDC, compared to selling 10-12 sarees per month offline. This represents roughly a 25-fold increase in revenue, achieved simply by accessing customers without geographic limitation and without surrendering 15-20% commissions to a marketplace.

Paanal Farms, an organic produce collective born from the frustration of farmers receiving inadequate prices through traditional supply chains, found in ONDC the mechanism to connect directly with quality-conscious urban consumers. The platform provided the visibility and infrastructure that would have previously required partnering with organized retail at unfavorable terms.

Similarly, Shraddha Super Shop in rural Maharashtra achieved 2X sales growth after joining ONDC, demonstrating that the opportunity extends beyond artisanal products to everyday retail in smaller markets. What these examples share is a common theme: businesses previously trapped in local geographies or dependent on exploitative intermediaries discovered a path to scale without surrendering operational autonomy or accepting unreasonable commission structures.

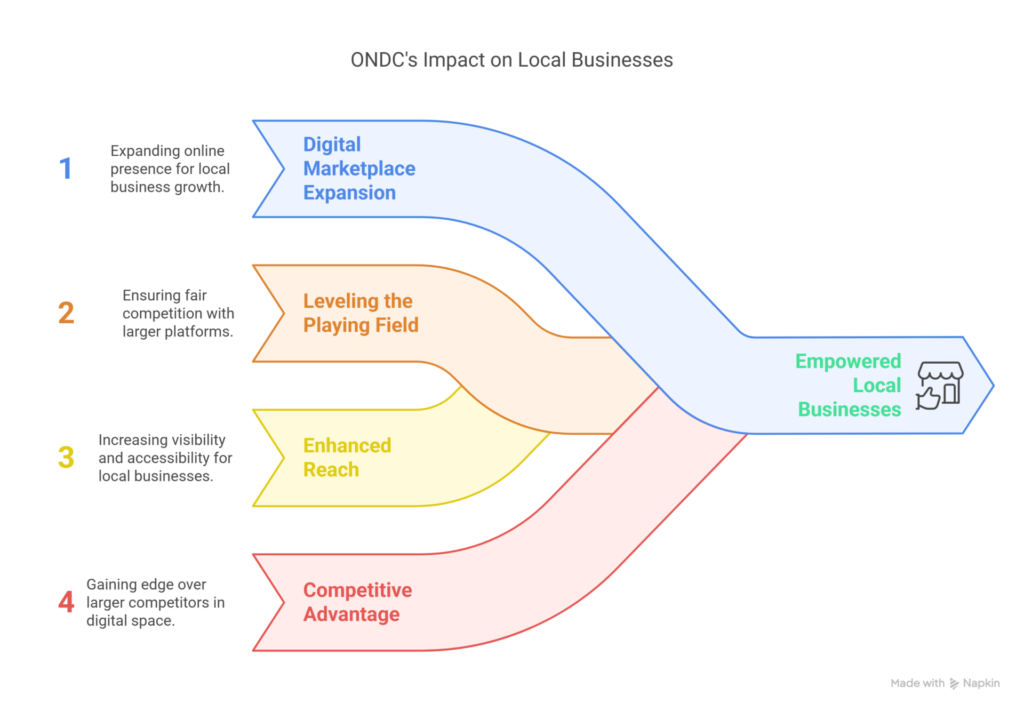

Strategic Advantages for Local Businesses: A Comprehensive Analysis

1. Cost Efficiency: Moving from Fixed Extraction to Variable Partnership

The most immediate benefit of ONDC is financial. The low transaction fee creates a fundamentally different business model for small retailers.

Traditional e-commerce platforms operate on a “vig” principle—they extract value regardless of your profitability. Your costs are fixed percentages. ONDC inverts this dynamic. You pay only for successful transactions, and the fee is transparent and minimal.

For context, a small business operating on a 20% gross margin retaining 5% net profit (a realistic scenario for retail) faces these economics:

- Traditional Platform: 15% commission + 2.5% payment processing + 2% logistics coordination = 19.5% of revenue to the ecosystem. Profitability is essentially eliminated.

- ONDC: 0.5% transaction fee + payment processing retained by you (competitive at 1-2% via your chosen gateway) + direct logistics negotiation. Net impact: 3-4% of revenue to the ecosystem.

This isn’t merely a cost reduction; it’s a fundamental structural shift that makes digital commerce viable for businesses previously priced out of the online marketplace. Government schemes like the Trade Enablement and Marketing (TEAM) scheme specifically support small enterprises in joining ONDC, recognizing this leverage point.

2. Autonomy and Control: Reclaiming Your Business Strategy

Beyond economics, ONDC restores something precious to small business owners: control. This cannot be overstated.

In traditional e-commerce, the platform decides:

- Which products appear prominently (algorithm opacity)

- What pricing you can offer

- Customer service policies you must follow

- Terms under which your listing can be suspended

- Return and refund policies

In ONDC, you determine these elements. You set prices, control your inventory visibility, define your service policies, and manage customer relationships directly. Multiple buyers can carry your products simultaneously, and you’re not competing for algorithmic favor within a single platform’s proprietary system.

For businesses accustomed to operating independently—as most small retailers are—this restoration of autonomy is psychologically liberating and strategically powerful. You’re no longer in a tenant relationship with a platform; you’re a participant in an open network where success depends on product quality and customer service, not algorithmic manipulation.

3. Market Access Without Geographic Constraint

One of ONDC’s most transformative features is geographic reach without platform-specific onboarding friction.

A small producer in a Tier-3 city faces an intimidating proposition on Amazon: navigate complex seller registration, maintain storage infrastructure, compete with thousands of established sellers in the same category, navigate return logistics. ONDC flattens this landscape. By January 2026, ONDC operates across 500+ cities and towns, spanning metros, Tier-2, and Tier-3 markets.

For a small artisan collective or regional FMCG producer, this represents access to millions of potential customers without requiring presence in major e-commerce hubs. The infrastructure for logistics, payment processing, and customer support comes as part of the network, not something each business must negotiate individually.

Women entrepreneurs have particularly benefited. Women-led businesses joining ONDC have achieved outsized success—Anubhuti, a women-led experience brand, achieved 4X usual sales in the first four months after onboarding. The reasons are partly structural: ONDC’s transparent commission model and direct customer access reduce the information asymmetries that often disadvantage women entrepreneurs in negotiating with traditional platforms.

4. Interoperability as Competitive Advantage

Perhaps ONDC’s most sophisticated benefit is the competitive dynamic it creates.

In centralized marketplaces, network effects work against small sellers. Once Amazon establishes dominance, all customers shop there, so all sellers must be there, giving Amazon monopolistic pricing power. ONDC inverts this. Customer loyalty is to the buyer app of their choice (which might emphasize price, convenience, or reliability), not to the network. Sellers can participate across multiple buyer apps. The competitive pressure flows downward toward service providers, not upward toward a dominant platform.

This is economically healthy. It encourages:

- Price Competition: Customers can compare across sellers on multiple buyer apps, forcing competitive pricing

- Service Innovation: Logistics providers compete on speed and reliability; payment gateways on processing efficiency; service providers on feature richness

- Seller Choice: You’re not locked into a single buyer interface; your products appear across multiple competing platforms

For businesses emerging from India’s traditional retail sector, this represents a first genuine experience with market competition in digital commerce.

The Mechanics: Getting Started with ONDC

Onboarding Process: Practical Steps

Joining ONDC is simpler than penetrating traditional platforms, though it requires strategic preparation.

The process involves:

- Select an Approved Service Provider: ONDC works through service providers who manage the technical integration, training, and operational support. Examples include Gofrugal, Vikra, and various niche solutions. These providers handle the complexity of network protocols, allowing you to focus on business fundamentals.

- Complete Seller Registration: Unlike Amazon’s evaluation process, ONDC onboarding is relatively straightforward. You’ll provide basic business documentation, verify identity, and set up banking information for fund settlement.

- Catalog Integration: Work with your service provider to integrate your product catalog. This involves standardized data formatting—product descriptions, images, inventory counts, pricing.

- Payment and Logistics Setup: Configure payment gateway preferences and logistics partners. ONDC enables you to negotiate directly with logistics providers or leverage platform-integrated options.

- Go Live and Monitor: Once cataloging is complete, your products become visible across ONDC buyer applications. You monitor orders, process shipments, and manage customer communication through your dashboard.

The entire process typically takes 2-4 weeks for straightforward product categories. Complex categories with specific compliance requirements might require longer.

Operational Considerations

Success on ONDC requires attention to operational excellence:

Inventory Management: Unlike traditional retail where inventory sits in physical stores, ONDC requires real-time inventory accuracy. Overselling or understocking damages your seller rating, reducing visibility across the network.

Order Fulfillment Speed: ONDC metrics track fulfillment timelines. Businesses that pack and ship quickly gain algorithmic preference, creating a virtuous cycle of increased visibility and orders.

Customer Service Excellence: Since you’re no longer protected by platform intermediation, customer satisfaction becomes your direct responsibility. Response time, return handling, and issue resolution directly influence your rating and visibility.

Pricing Strategy: ONDC’s transparency means customers can compare your prices against competitors easily. This requires either delivering genuine value through quality, service, or specialization, or competing on price efficiency. Arbitrary price premiums don’t work.

The businesses thriving on ONDC treat these operational elements as competitive advantages, not compliance burdens.

Addressing the Challenges: A Realistic Assessment

Technical and Infrastructure Barriers

While ONDC democratizes digital commerce, significant barriers remain, particularly for very small businesses and those in rural areas.

Digital Literacy Gaps: Many small retailers, particularly those operating in Tier-3 cities or rural areas, lack familiarity with digital systems. ONDC’s service providers offer training, but the learning curve can be steep. An 55-year-old traditional grocer in a small town faces a different onboarding experience than a 25-year-old tech-savvy entrepreneur.

Infrastructure Requirements: Reliable internet, device access (computer or smartphone), and basic technical competency are prerequisites. While India’s telecom infrastructure has improved dramatically, rural and remote areas still have connectivity challenges that limit ONDC participation.

Banking and Payment Integration: ONDC requires direct bank account integration for receiving payments. Businesses without formal banking relationships or those skeptical of digital financial systems face friction in the onboarding process.

Adoption Friction and Mindset Challenges

Beyond technical barriers, psychological and organizational factors slow adoption.

Many small business owners have operated successfully for decades without digital systems. The perceived complexity of ONDC, combined with unfamiliarity with online business models, creates hesitation. This is particularly pronounced among older entrepreneurs who may view digital commerce skeptically.

Additionally, early adopters on ONDC sometimes discover that simply listing products doesn’t generate sales. Effective ONDC participation requires product photography, compelling descriptions, competitive pricing analysis, and proactive marketing—skills distinct from traditional retail.

The Competitive Dynamics Question

ONDC’s long-term sustainability depends on maintaining genuinely open competition. Early signs suggest this is evolving:

The network’s architecture prevents pure monopoly, but large players might accumulate advantages through:

- Scale advantages in logistics: Established players negotiating lower delivery rates

- Data analytics sophistication: Larger entities optimizing pricing and inventory more effectively

- Capital for marketing: Well-funded players gaining disproportionate buyer attention

ONDC’s governance must actively monitor whether competitive dynamics remain healthy as the ecosystem matures. So far, the evidence suggests healthy competition—Category growth varies widely, multiple players dominate different sectors, and entry barriers remain low compared to traditional platforms.

The Broader Economic Implications

Digital Inclusion and Economic Opportunity

ONDC’s significance extends beyond individual business success. It’s fundamentally about economic inclusion.

Traditional e-commerce penetration in India remains approximately 4.3% of retail. This represents enormous untapped potential. Much of this gap exists precisely because small retailers—comprising 90%+ of Indian retail—couldn’t access digital commerce on economically viable terms.

ONDC addresses this at scale. By January 2026, the network had onboarded approximately 7.6 lakh sellers and service providers. Many represent first-time digital commerce entrants from small towns and rural areas. Craftspeople, farmers, local manufacturers, and neighborhood retailers suddenly have infrastructure to reach national markets.

Government schemes reinforce this inclusion imperative. The TEAM scheme specifically targets onboarding 2+ lakh micro and small enterprises onto ONDC, with half designated as women-owned. This represents deliberate policy design to ensure digital commerce benefits don’t concentrate in urban metros among established players.

The Farmer-Consumer Bridge

ONDC has particular significance for agricultural commerce. Farmers have traditionally sold through exploitative middlemen offering below-market prices. ONDC creates direct farmer-to-consumer channels. Initiatives like the Telangana model—where farmers sell directly through ONDC to urban consumers—disintermediate supply chains, improving farmer economics while reducing consumer prices.

Employment and Entrepreneurship

The platform’s structure encourages entrepreneurship. Young people in small towns now see viable business opportunities, not because it’s easier to raise venture capital, but because digital infrastructure for commerce is suddenly accessible and affordable. Service providers, logistics operators, photography and listing specialists, and business consultants are emerging in local markets to support ONDC sellers—creating employment diverse from traditional service sectors.

Looking Forward: The Future of ONDC and Local Commerce

Growth Projections and Market Expansion

ONDC leadership projects daily transactions scaling from 5-6 lakh to nearly 60 lakh by end of 2026—a 10-12X increase. This assumes continued adoption by both sellers and buyers. The trajectory, while aggressive, isn’t implausible given current momentum and the network’s structural advantages.

Geographic expansion beyond India remains theoretical but increasingly probable. ONDC’s architecture is designed to operate across borders. Government-backed digital commerce infrastructure exists in select other nations. Regional variants of ONDC might eventually create a broader South Asian digital commerce network, allowing Indian small businesses access to neighboring markets.

Category Expansion Beyond Core Retail

ONDC has already expanded beyond traditional e-commerce into:

- Mobility: Metro ticketing, intracity buses, and taxi services. ONDC covers 80% of India’s metro ticketing inventory and operates across 21 cities for bus ticketing.

- Financial Services: Micro-SIPs and insurance products are being distributed through ONDC, with 70% of new investors from Tier-2 cities.

- Logistics and Supply Chain: B2B logistics services are being integrated, potentially transforming how businesses manage supply chains.

This vertical integration suggests ONDC isn’t merely a marketplace but infrastructure for open commerce across diverse sectors. Businesses that understand ONDC’s mechanisms in retail context can apply this knowledge across these expanding verticals.

Potential Risks and Evolution Points

Not everything about ONDC’s future is certain. Risks include:

Platform Fragmentation: If too many incompatible implementations emerge claiming ONDC compliance, interoperability benefits could diminish.

Predatory Buyer-Side Consolidation: Large organized retail could theoretically use buyer applications to extract monopolistic advantages, replicating platform dominance in new form.

Regulatory Complexity: Government policies favoring or constraining ONDC participation could materially affect growth trajectories.

Despite these risks, the structural incentives favor continued evolution toward more open, competitive digital commerce. The question isn’t whether ONDC will succeed in principle—it already has at scale. The question is whether success remains broadly distributed across diverse business types or whether advantages concentrate among sophisticated players.

Practical Recommendations for Local Businesses

Prerequisites for Success

Before joining ONDC, assess your readiness:

- Product-Market Fit: Do you have products customers genuinely want at competitive prices? ONDC amplifies signal—great products and services thrive; mediocre offerings struggle.

- Operational Capacity: Can you reliably handle increased order volume, manage inventory in real-time, and maintain service standards?

- Financial Runway: While ONDC fees are low, you’ll still need working capital for inventory and initial scaling. Typical businesses need 2-3 months runway to reach break-even.

- Technical Comfort: You or someone on your team must be comfortable with basic digital systems—dashboard navigation, basic analytics interpretation, email communication.

Strategic Approach to ONDC Integration

Rather than viewing ONDC as a standalone sales channel, integrate it into comprehensive commerce strategy:

- Omnichannel Thinking: ONDC should complement offline presence, not replace it. Customers discovered through ONDC might purchase offline; offline customers might discover you online.

- Differentiation Focus: In O N D C’s transparent environment, competing purely on price is unsustainable. Build differentiation through product quality, service excellence, unique offerings, or superior expertise.

- Data-Driven Iteration: O N D C dashboards provide rich operational data—which products sell, at what price points, to which geographies. Use this data to optimize inventory, prioritize product development, and refine marketing.

- Customer Relationship Continuity: Don’t view O N D C sales as transactional. Build relationships through follow-up communication, loyalty incentives, and exclusive offerings that make customers return.

Leveraging Service Providers Effectively (ONDC)

Your choice of O N D C service provider significantly impacts success. Evaluate based on:

- Local Presence: Can they provide hands-on support in your region, or are they entirely remote?

- Vertical Specialization: Do they understand your specific product category, its compliance requirements, and customer dynamics?

- Analytics and Optimization Tools: Beyond basic integration, do they help you analyze performance data and optimize strategy?

- Fee Structure: Compare total cost of service provider fees plus O N D C transaction fees. Some providers offer better value for specific business types.

Don’t default to the cheapest provider. The right service provider becomes a strategic partner in your digital transformation, not merely a technical integrator.

Conclusion: ONDC as Economic Catalyst

O N D C represents more than an e-commerce platform. It’s an expression of policy deliberation around how digital infrastructure should function in inclusive economies. It’s also a pragmatic recognition that India’s retail future depends on successfully integrating 10+ million small merchants into digital commerce on economically viable terms.

For local businesses, O N D C solves a genuine problem: it enables profitable digital commerce participation without surrendering operational autonomy or accepting unreasonable commission structures. Early evidence—350+ million transactions, 7.6 lakh sellers, 10-fold projected growth—suggests this is working at significant scale.

The platform isn’t perfect. Technical barriers, adoption friction, and questions about long-term competitive dynamics remain. But the fundamental architecture—open, interoperable, transparent, and designed for broad participation—addresses decades of distortion in Indian digital commerce.

For small business owners, entrepreneurs, and professionals advising them, O N D C merits serious attention. It’s no longer speculative. It’s operational infrastructure transforming how commerce happens in India. Businesses that understand and leverage O N D C effectively will increasingly outcompete those operating exclusively through traditional channels or traditional platforms.

The future of Indian retail likely isn’t dominated by a handful of e-commerce giants extracting rents from merchants. It’s an increasingly open ecosystem where local businesses retain autonomy, compete fairly, and participate in commerce on terms closer to economic reality. O N D C makes this future possible.

This analysis reflects January 2026 market conditions and O N D C’s operational status. As the platform continues evolving, specific features, fee structures, and strategic recommendations should be reviewed periodically against current market developments.

One Comment